Key Insights:

- Solana’s DeFi TVL hits $4.6 billion, marking a 23-month high, driven by memecoin mania and network growth.

- Memecoins like Dogwifhat, BONK, and Book of Meme are fueling Solana’s surge, flipping Ethereum in trading volume.

- Solana investors exhibit strong belief in future price surges, withdrawing $200 million from exchanges to wallets within a week.

Solana is once again capturing the spotlight as its price rallies amidst a frenzy of memecoin activity on its network. After enduring a period of decline, SOL has witnessed a remarkable turnaround, with its price climbing from $170 in the last 48 hours, showcasing a more than 10% gain. The surge comes amidst a broader market uptrend, with SOL’s year-to-date increase exceeding 800%, soaring from under $20 in March 2023.

The recent spike in Solana’s price can be attributed to the soaring popularity of memecoins on the network, including Dogwifhat (WIF), BONK, and Book of Meme (BOME). These memecoins have not only attracted investors but have also propelled SOL’s trading volume to surpass Ethereum’s in recent times.

Solana’s DeFi Sector Reaches Milestone

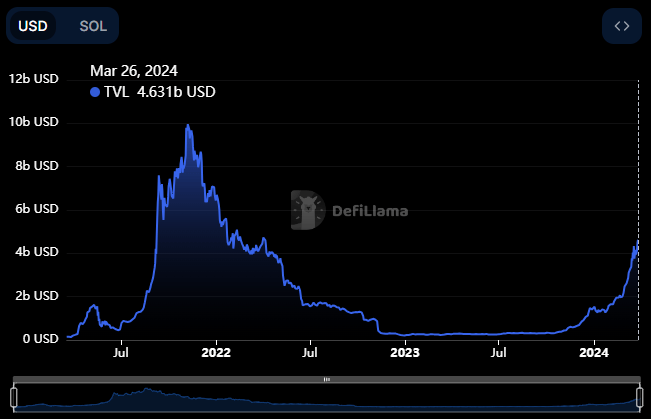

Solana’s decentralized finance (DeFi) sector has witnessed a significant milestone, with its total value locked (TVL) crossing $4.6 billion for the first time in almost two years. This surge in TVL highlights the growing prominence of SOL’s ecosystem, especially in the realm of meme coins.

SOL TVL: DeFiLlama

According to data from the blockchain analytics platform DeFiLlama, Solana’s DeFi sector reached its highest TVL of $4.82 billion in April 2022 before experiencing a downturn due to various factors, including the FTX collapse. However, recent months have seen a resurgence, with projects like Marinade, Jito, Kamino Finance, MarginFi, and Raydium contributing to the market’s surge.

Despite the fluctuations witnessed last year, SOL’s DeFi sector has bounced back impressively, surpassing the $2 billion TVL mark late last month and now reaching a 23-month high. This resurgence in Solana’s DeFi TVL coincides with the network’s decentralized exchange (DEX) market witnessing substantial growth.

Massive Withdrawals from Exchanges Predict an Upward Surge

Solana holders have exhibited strong conviction in the cryptocurrency’s potential for growth, evidenced by a substantial withdrawal of funds from centralized exchanges to on-chain wallets over the past week.

Data sourced from SolanaFM reveals that approximately $200 million worth of Solana has been shifted from exchanges to wallets within the Solana network. Notably, Binance spearheaded this movement with a staggering $182 million transferred to cold wallets, as indicated by on-chain data from DefiLlama.

Interestingly, while exchanges like Bybit and Bitfinex experienced net outflows amounting to $19.1 million and $1.035 million, respectively, OKX recorded a net inflow of $9.23 million. This divergence suggests varied sentiments among Solana holders regarding the future trajectory of the cryptocurrency.

The peak of these withdrawals occurred on March 20, coinciding with a market rebound following a brief dip where Bitcoin traded below $61,300. Such mass withdrawals from exchanges reflect a collective belief among Solana investors in the potential for significant price appreciation in the near term.

Solana Price Analysis

Ranked fifth in the cryptocurrency market, SOL witnessed a pullback following a surge to $210 last week, attributed to increased selling pressure. Starting the week at $200, SOL peaked at $210 before concluding the week at $183, marking a decline of 10%.

Observing SOL’s market movement today, Solana’s upward trajectory has hit a snag as bearish sentiment overtakes bullish momentum. Despite encountering a slight dip to $188, marking a marginal decrease of 1.28%, SOL has predominantly traded in positive territory throughout today’s session.

SOL/USD price chart: CoinMarket Cap

The market capitalization has now dwindled to $83 billion, accompanied by a 12% decline in trading volume, totaling $3.6 billion. This decrease in volume hints at heightened selling pressure within the market. Despite the current bearish trend, SOL has gained 3% and 80% on the weekly and monthly charts, respectively.

Solana Technical Analysis

Should SOL breach the resistance barrier of $200, it could signal a resurgence of bullish sentiment, potentially propelling its value toward the $210 mark. A breakthrough beyond this level may pave the path towards reaching its all-time high (ATH) in the sessions ahead.

Conversely, a reversal in the trend could lead SOL to retrace back to its immediate support at $170. In the event of prevailing selling pressure, the price may further decline to the $150 support zone, indicating a bearish outlook for the market.

Looking at the daily technical indicators for SOL, signs of a strengthening uptrend are apparent. The Relative Strength Index (RSI) maintains its position above the neutral zone at 63, indicating considerable interest from buyers at these levels.

SOL/USD chart: TradingView

Additionally, the Commodity Channel Index (CCI) exhibits robust bullish momentum with a positive value, while the upward-trending trendline adds further confirmation to the bullish outlook.