Key Insights:

- Bitcoin shorts capitulate, potentially paving the way for a bullish breakout, as analyst highlight a shift in market sentiment.

- Traders anticipate a short-term surge in Bitcoin’s price as shorts scramble to cover their positions, adding to buying pressure in the market.

- Robert Kiyosaki’s bullish outlook on Bitcoin underscores its potential as a hedge against economic uncertainty, advocating for strategic accumulation strategies.

Bitcoin’s recent surge to challenge the $68k resistance level has ignited fervor in the cryptocurrency market. Over the past week, Bitcoin witnessed a notable climb from $61k to above $65k, buoyed by robust investor interest. There has been a tight tussle near the 20-day exponential moving average, suggesting a showdown between bullish and bearish forces.

This rally, albeit impressive, comes after a brief dip, indicating the resilience of Bitcoin amidst market fluctuations. Consequently, analysts foresee the potential for further upward momentum, propelled by the current buying spree. However, the market remains vigilant, mindful of the ongoing battle between buyers and sellers.

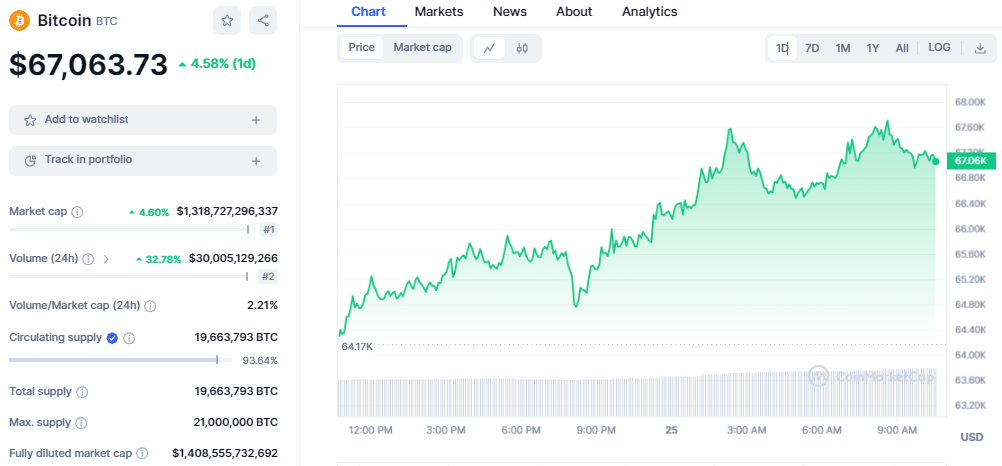

BTC/USD price chart: CoinMarket Cap

As of this writing, Bitcoin is exchanging hands at $67,063 as the bullish momentum builds. The buyers have outshined the bears, forming an uptrend pattern on the daily chart as BTC rallied from $64k to $68k region, an increase of 4%. On the weekly chart, BTC has seen a decrease of 1%, while the monthly chart displays an impressive rise of 30%. The market cap and trading volume are on the increase, too, with their values at $1.3 trillion and $30 billion.

Table of Contents

ToggleBitcoin Poised for a Bullish Breakout?

Bitcoin’s trajectory hints at a potential bullish rally spurred by notable shifts in market sentiment, according to insights shared by crypto analyst MartyParty. Despite its recent inability to reclaim the $70k price threshold following a new ATH of $73k in March, BTC might be gearing up for a significant uptick in price action.

Shorts appear to have capitulated – are we going to the moon. 👀 pic.twitter.com/nFulwwlAW5

— MartyParty (@martypartymusic) March 24, 2024

The analyst highlights a key development: the capitulation of Bitcoin shorts. These traders, who previously bet on BTC’s decline, have been observed closing their positions en masse. This collective action suggests an imminent short squeeze, where short sellers rush to cover their positions by purchasing Bitcoin. Consequently, this surge in buying pressure could drive BTC prices higher in the short term.

The data shared by MartyParty underscores the potential for a bullish breakout, with implications that extend beyond immediate price movements. As shorts unwind their positions, market dynamics appear poised for a shift, possibly paving the way for BTC’s ascent “to the moon,” as suggested by the analyst.

Investor Robert Kiyosaki Bolsters Bitcoin Bet, Eyes $100,000 Valuation

Renowned investor and author Robert Kiyosaki recently emphasized his bullish stance on Bitcoin, advocating for its acquisition as he foresees substantial growth potential. Kiyosaki plans to procure an additional 10 Bitcoins before April, citing the upcoming halving event as a significant factor driving his decision.

I am buying 10 more Bitcoin before April. Why? The “Having.” If you can’t afford a whole Bitcoin you may want to consider buying 1/10 of a coin, via the new ETFs or Satoshi’s.

— Robert Kiyosaki (@theRealKiyosaki) March 25, 2024

If the Bitcoin process works as designed you may own a whole Bitcoin by the end of this year.

I…

Kiyosaki underscores the importance of diversifying from traditional fiat currencies, which he deems as “fake” money, alongside fellow investors Michael Saylor and Andy Schectman. Amid escalating economic uncertainties and geopolitical tensions, Kiyosaki warns of the risks associated with relying solely on fiat currencies, suggesting that such a strategy could lead to financial vulnerability.

Kiyosaki’s strategy involves not only investing in whole Bitcoins but also fractional ownership through methods like ETFs or Satoshis, reflecting his confidence in BTC’s potential appreciation. He encourages individuals to consider these options, particularly for those unable to afford an entire Bitcoin.

The belief in BTC’s trajectory towards a value of $100,000 by the year’s end aligns with Kiyosaki’s optimistic outlook, buoyed by the cryptocurrency’s scarcity and growing adoption. With the BTC process operating as intended, Kiyosaki anticipates the possibility of individuals achieving whole Bitcoin ownership by the conclusion of the year.

Bitcoin Technical Outlook

Looking at the technical outlook, BTC displays a bearish outlook as most indicators lie in the negative territory. The Relative Strength Index (RSI) is currently lying in the neutral region, indicating that BTC is not overbought or oversold. On the Bollinger bands, BTC is facing rejection on the middle band at 67,750 as a red candlestick is observed forming.

BTC/USD chart: TradingView

The Moving Average Convergence Divergence (MACD) indicator, the MACD line, is still trending below the signal line despite both of them hovering above the zero line. However, despite the histogram lying in the negative territory, the red bars are fading away, suggesting a decrease in selling pressure, which could lead to a shift toward a bullish trend.