Key Insights:

- Ethereum’s price decline of 1.26% accompanies a notable 10% drop in trading volume, reflecting decreased market activity.

- Ethereum’s recent performance signals a bullish trend, with the cryptocurrency targeting the $3,700 resistance for further gains.

- Steven McClurg of Valkyrie suggests the SEC’s approval for an Ethereum ETF might be delayed due to regulatory debates.

Following a period of consolidation, cryptocurrency tokens have surged, suggesting the possibility of reaching new record highs soon. Bitcoin, the dominant player in the market, has been spearheading this resurgence. In contrast, Ethereum, the second-largest digital currency in terms of market value, has chosen a steadier path to recovery.

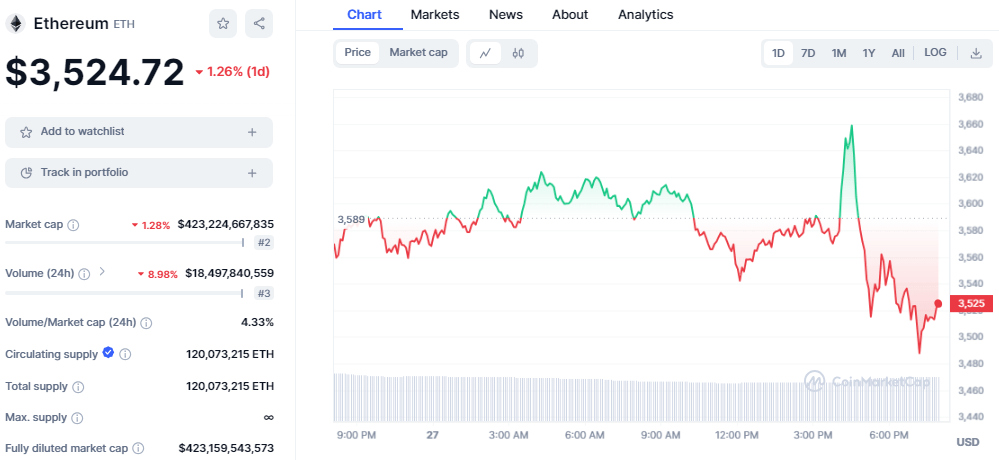

ETH/USD price chart: CoinMarket Cap

As of this writting, ETH is currently trading at $3,524, showing a slight decrease of 1.26% within the past 24 hours. This decline in price is accompanied by a corresponding 10% decrease in ETH’s 24-hour trading volume, which now sits at $18 billion. The market capitalization has decreased to $423 billion.

Table of Contents

ToggleSEC Unlikely to Greenlight Ethereum ETF in May

Valkyrie Investments’ co-founder, Steven McClurg, has expressed skepticism regarding the approval of a spot Ethereum ETF this coming May. During a discussion at the Digital Wildcatters Empower Conference, McClurg highlighted the ongoing regulatory scrutiny surrounding ETH. He suggested that this scrutiny could defer the ETF’s approval by the U.S. Securities and Exchange Commission (SEC).

McClurg’s viewpoint gained traction after Fox Business reporter Eleanor Terrett shared these insights on her X account. The Valkyrie CIO’s concerns stem from the ongoing debate over Ethereum’s classification. He posited that ETH “could be a security,” echoing the sentiments of recent investigations targeting the Ethereum Foundation. This uncertainty contrasts with the earlier stance of some SEC officials, who did not classify Ethereum as a security.

🚨NEW: Some key takeaways from my fireside chat at @DWildcatters Empower Conference with @ValkyrieFunds CIO @stevenmcclurg:

— Eleanor Terrett (@EleanorTerrett) March 27, 2024

📌He believes $ETH could be a security and the spot ETF will not get approved in May.

📌He thinks it’s more likely a $LTC or $XRP spot ETF gets approved… pic.twitter.com/6VjaBEXubL

Moreover, the U.S. Commodity Futures Trading Commission (CFTC) has categorized both Ethereum and Litecoin as commodities. This designation was notably referenced in a recent lawsuit against the cryptocurrency exchange KuCoin. However, McClurg anticipates that the SEC might favor approving spot ETFs for either Litecoin or XRP before considering Ethereum.

This prediction aligns with observations from Eric Balchunas, a senior ETF analyst at Bloomberg. Balchunas noted a decrease in the likelihood of a May approval for an ETH ETF, citing a lack of engagement between the SEC and ETF issuers. Indeed, the SEC has postponed decisions on various Ethereum ETF proposals in recent weeks, including those from major players like BlackRock and Fidelity.

Re Eth ETF approval, we are holding the line at 25% odds altho tbh it is a very pessimistic 25%. The lack of engagement seems to be purposeful vs procrastination. No positive signs/intel anywhere you look. Personally hope they do approve it but it just ain't looking good. https://t.co/nuBdCDE18L

— Eric Balchunas (@EricBalchunas) March 25, 2024

Ethereum Price Analysis

Ethereum’s value is on an upward trajectory, maintaining a strong position above the $3,500 benchmark. The digital currency’s next challenge lies in surpassing the $3,700 resistance to secure further growth in the short term. This recent uptick began when ETH pushed past the $3,500 resistance zone, demonstrating the strength in the market.

The climb continued, with Ethereum breaking the $3,650 resistance barrier. However, after reaching a peak at $3,700, the cryptocurrency experienced a slight correction, dipping below the $3,600 mark.

Now, to sustain its upward momentum, ETH faces immediate resistance at $3,600. A significant hurdle awaits at $3,700, followed by another crucial point at $3,750. Overcoming these barriers could unleash bullish energy, potentially propelling ETH towards the $3,800 and even the $3,900 resistance levels. A breach above $3,800 might pave the way for a test of the $4,000 threshold.

Conversely, should ETH stumble at the $3,600 resistance, a downward trend could ensue. Initial support lies near the $3,580 mark, followed by a major support zone at $3,550. A decisive drop below the $3,500 support could steer Ethereum towards the $3,400 region, with further losses possibly leading down to $3,200.

Ethereum Technical Outlook

Looking at Ethereum’s technical front, ETH is trading on a neutral stance. Indicators such as Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) suggest a neutral market.

ETH/USD chart: TradingView

On the MACD indicator, the MACD line is trending flat below the signal line, which suggests a break on either side in case of a breakout. In case bullish momentum is restored, the MACD line could trend upwards toward the signal line, shifting the histogram into the positive territory.

In addition, the RSI is hovering around the 50 index, indicating a neutral market whereby a drop below this level could send ETH toward the oversold region. ETH is currently trading above the 20-day Exponential Moving Average, indicating a sell signal.