Key Insights:

- Despite facing resistance at $3,500, Ethereum’s sustained trading above $3,400 indicates bullish momentum, fostering optimism for further upward movement.

- Ethereum’s scaling potential reaches new heights with Dencun Upgrade, fueling innovation and promising enhanced scalability for the Layer 2 ecosystem.

- Ethereum’s bullish reversal, supported by indicators like RSI and Bollinger Bands, signals growing momentum and potential for upward movement.

The cryptocurrency market has seen a recent uptick, witnessing a 2.85% rise in overall market capitalization to hit $2.45 trillion. This surge indicates heightened volatility, prompting scrutiny of the performance and future outlooks of major currencies like Bitcoin and Ethereum.

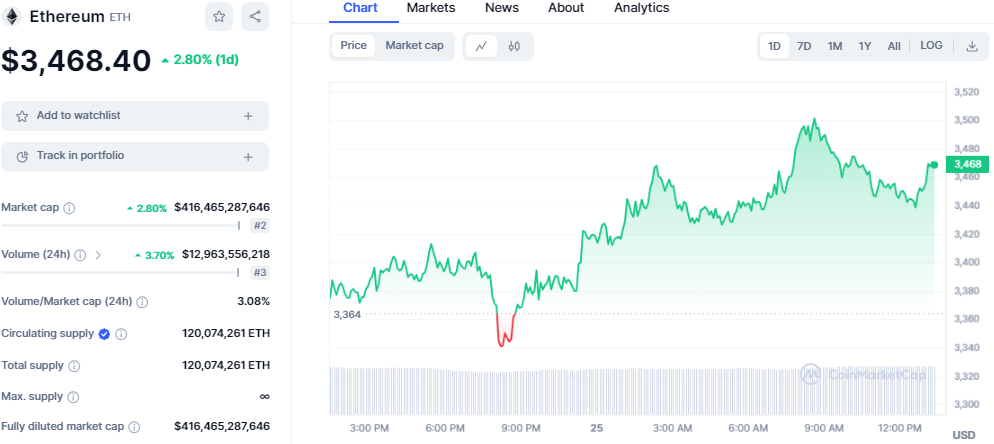

As of this writting, ETH is trading on a bullish note, hovering above the $3,400 level. The price is standing at $3,468, an increase of 2.80% in the past 24 hours. Ethereum’s daily low and high have been noted at $3,335 and $3,500, respectively.

ETH/USD price chart: CoinMarket Cap

The market capitalization and the trading volume are on the rise, with their values surging to $415 billion and $12 billion, an increase of 2.80% and 2.70 %, respectively. The overall surge indicates an increase in buying pressure, which could send the price higher in the coming sessions if the current trend holds.

Table of Contents

ToggleEthereum Scaling Peaks Post Dencun Upgrade

Amid Ethereum’s recent Dencun Upgrade, scaling factors are hitting new peaks, signaling an imminent surge toward an all-time high. This development foretells a significant wave of innovation within the Ethereum Layer 2 ecosystem.

Dencun was just the beginning.#Ethereum's scaling factor remains at peak levels, with indicators pointing towards a new all-time high imminently.

— Leon Waidmann | Onchain Insights🔍 (@LeonWaidmann) March 25, 2024

Expect a groundbreaking wave of innovation within the #ETH Layer 2 ecosystem, promising transformative growth and scalability. pic.twitter.com/V5alk01kj8

Consequently, we anticipate transformative strides in growth and scalability within the ETH network. The Dencun Upgrade acts as a catalyst for this momentum, propelling Ethereum into a phase of enhanced performance and efficiency.

Moreover, experts predict that these advancements will bolster ETH’s position in the crypto landscape, attracting increased attention from investors and developers alike. The stage is set for Ethereum to cement its status as a frontrunner in the blockchain sphere.

Ethereum Price Analysis

Amidst a backdrop of steady support above the $3,200 mark, ETH is poised for a potential breakout towards the $3,600 resistance level. Currently trading above $3,400, the cryptocurrency seeks to solidify its gains, indicating a positive sentiment among traders.

Having established a foundation above $3,200, ETH initiated a fresh uptick, surpassing the $3,350 resistance barrier. However, to sustain this upward momentum, ETH must overcome the significant hurdle at $3,600 in the short term.

Analysis highlights that a successful breach of the $3,600 resistance could pave the way for further gains, with the next notable resistance lying at $3,700. A breakthrough beyond this level could trigger a bullish surge towards $3,800, and potentially even $3,900, before targeting the crucial $4,000 threshold.

Conversely, failure to surpass the $3,600 resistance might prompt a downside correction. Initial support is expected to be near $3,400, followed by a more substantial support zone at $3,200. Further downward movement could lead Ethereum towards $3,100, with $3,000 looming as a critical support level in case of extended losses.

Ethereum Technical Outlook

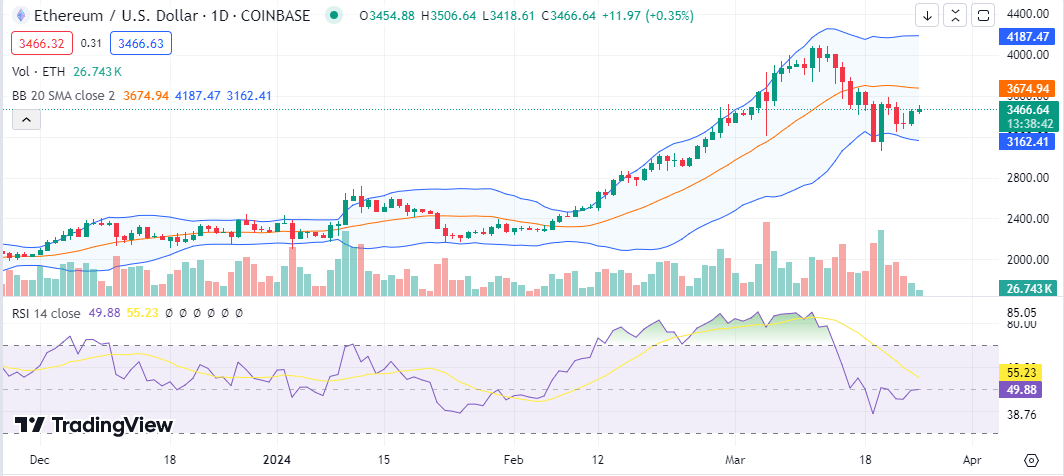

Ethereum displays a bullish reversal on the daily chart as bulls take the lead. The bulls have made a comeback as most indicators retreat from the negative territory. The Relative Strength Index (RSI), which dipped into the oversold region last week, has climbed to the neutral region, suggesting a bullish momentum building.

ETH/USD chart: TradingView

Looking at the Bollinger band indicator, ETH is trading on heightened volatility as the bands display a wide structure. However, ETH has formed an uptrend pattern on the lower band as a series of green candlesticks form heading to the middle band.