Key Insights:

- Investor sentiment sways as SEC delays and reduced approval odds cast shadows on the highly anticipated spot ether ETF by May.

- Eyes turn towards May 23, anticipating not only the final decision on VanEck’s ETH ETF but also the potential approval of BlackRock’s application.

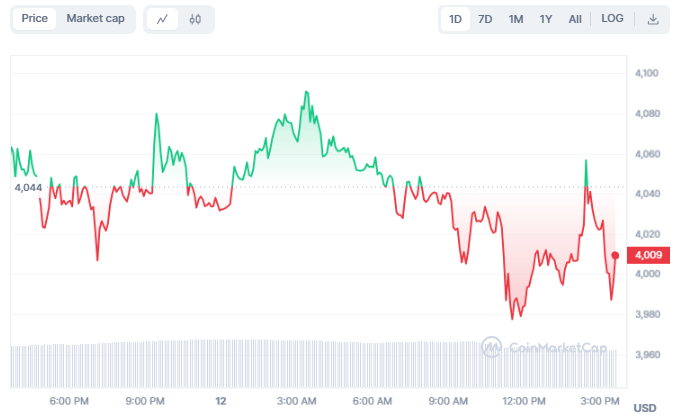

Ethereum successfully breached the $4,000 key level, marking a multi-month high above $4,050. The digital asset is now consolidating gains and exhibits signs of potential extension beyond the $4,100 zone. As of this writing, ETH is trading at $4,009, with a mere decrease of 1.19% in the past 24 hours.

ETH/USD price chart: CoinMarket Cap

Maintaining its bullish trend, Ethereum confidently surpassed the crucial $4,000 resistance level, settling comfortably above it. The cryptocurrency achieved a new multi-month high above $4,050, triggering a consolidation phase after a brief pullback.

A short-term breakout pattern has emerged, with a notable resistance forming at $4,100 on the hourly ETH/USD chart. This pattern indicates the potential for a continued upward movement, particularly if the $4,100 resistance zone is cleared.

Should Ethereum sustain its position above $4,000, the immediate challenge lies at the $4,050 level, followed by the first significant resistance at $4,100. Further gains could lead to a breakthrough towards $4,200, paving the way for a bullish momentum towards $4,300. Surpassing this level might propel Ethereum towards the $4,400 key level, with additional gains prompting a test of $4,500.

However, in the event of a failure to breach the $4,100 resistance, Ethereum could experience a downside correction. Initial support awaits at $4,000, followed by a more significant support zone around $3,900. Further downward movement may find support at $3,800, and a clear break below this level could lead to a test of $3,880, with potential further losses towards $3,600.

Table of Contents

ToggleEther ETF Approval Odds Plummet

Investor interest in near-term ether puts is on the rise. This shift is attributed to the diminishing likelihood of the U.S. Securities and Exchange Commission (SEC) approving a spot ether exchange-traded fund (ETF) by May, as highlighted in QCP Capital’s latest market insights.

The remarkable 70% year-to-date gain in Ethereum has primarily hinged on expectations of the SEC greenlighting a spot ETF. This approval would pave the way for traditional financial institutions to gain exposure to the second-largest cryptocurrency without direct ownership. Despite the SEC’s approval of numerous spot bitcoin ETFs in January, optimism for a similar outcome with ether is dwindling.

Bloomberg’s ETF analysts recently revised their estimates, reducing the probability of a spot ether ETF approval in May from 70% to 30%. The odds have plummeted from over 70% in January to 31% on Polymarket, a decentralized betting platform. Even JPMorgan, earlier this year, expressed skepticism, placing the likelihood of an SEC-approved ETH ETF by May at no more than 50%.

Yeah our odds of eth ETF approval by May deadline are down to 35%. I get all the reasons they SHOULD approve it (and we personally believe they should) but all the signs/sources that were making us bullish 2.5mo out for btc spot are not there this time. Note: 35% isn't 0%, still… https://t.co/QWQOGZjDC5

— Eric Balchunas (@EricBalchunas) March 11, 2024

The recent delay in the SEC’s decision on Blackrock and Fidelity’s applications for spot ETH ETFs has added uncertainty. Nonetheless, some observers hold onto hope, anticipating a potential approval for BlackRock’s ETF on May 23, coinciding with the final decision on VanEck’s ETH ETF application.

Ethereum Technical Outlook

Technical indicators such as MACD (Moving Average Convergence Divergence) and RSI (Relative Strength Index) display a bullish outlook. The MACD line (blue) is above the signal line (orange), indicating bullish momentum; however, it appears to be converging towards it, suggesting a potential weakening in upward momentum.

ETH/USD chart: TradingView

The RSI is at 81.44, which typically suggests that an asset may be overbought, which is often an indicator that it could experience a pullback or correction in price due to overvaluation.