Key Insights:

- Bitcoin experiences a 7% decline following a higher-than-expected 0.6% surge in US PPI inflation for February.

- Market anticipates heightened volatility leading up to the March 20 Federal Open Market Committee (FOMC) meeting.

- Large movements of BTC to exchanges may indicate selling pressure, potentially contributing to price declines.

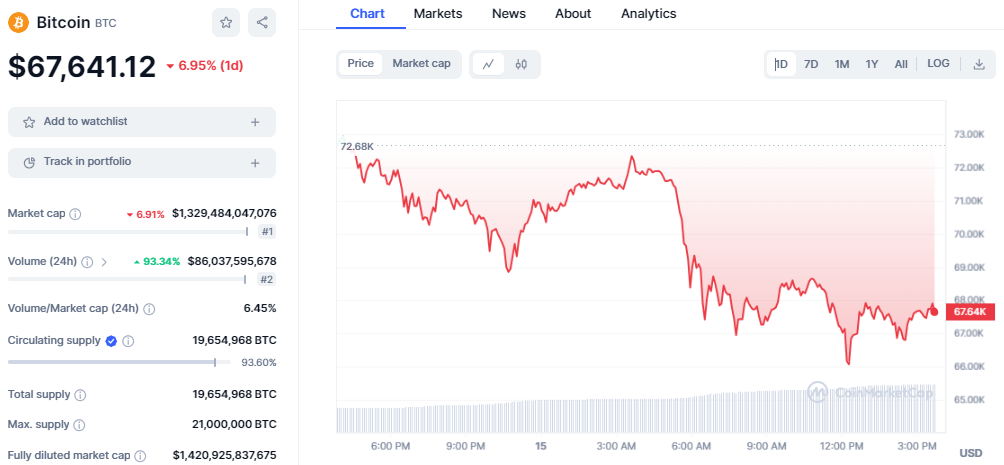

Bitcoin experienced a significant downturn in the crypto market, witnessing a sharp decline from its recent all-time high to a one-week low of $66,630. This sudden drop of more than 7% occurred after Bitcoin had been hovering around the record high of $73,800, showcasing the inherent volatility of the cryptocurrency market.

BTC/USD price chart: CoinMarket Cap

Despite some fluctuations, Bitcoin has been on a positive trajectory in recent weeks. Factors such as the increasing demand for the Spot Bitcoin ETF, evidenced by remarkable trading volumes and inflows, along with the anticipation surrounding the upcoming Bitcoin halving, have contributed to the bullish trend in BTC. Notably, Bitcoin remains approximately 60% higher for the year to date.

Amidst the crypto market shift, software firm MicroStrategy announced plans to raise capital through a convertible bond offering, intending to purchase Bitcoin for the second time in less than 10 days, signaling continued confidence in Bitcoin’s long-term prospects.

In February, US Producer Price Index (PPI) inflation witnessed an unexpected surge, climbing by 0.6%, surpassing analysts’ projections of a 0.3% increase. This rise, revealed by the Bureau of Labor Statistics, suggests heightened wholesale inflation, raising concerns among crypto market participants.

The spike in inflation comes ahead of the Federal Reserve’s upcoming March meeting, scheduled for next week. With the Federal Open Market Committee (FOMC) gathering on March 20, crypto market analysts anticipate continued volatility in both traditional and digital asset markets.

Following the release of the PPI data, the broader cryptocurrency market experienced a notable downturn. Bitcoin prices dipped, leading to a surge in demand for Bitcoin put options in the near term. Market experts highlight the likelihood of heightened volatility in the days leading up to the FOMC meeting, urging caution among investors amidst the changing crypto market dynamics.

Table of Contents

ToggleReasons Why Bitcoin is Down Today

A recent report indicated a potential interest rate cut by the Fed in June, aligning with the opinions of a majority of economists. However, following Bitcoin’s drop, the probability of a rate cut, as indicated by the CME FedWatch tool, has decreased from 74% to approximately 60%.

Matt Simpson, Senior Market Analyst at City Index, remarked on the volatility of the BTC market and the implications for the Fed’s decision, stating,

“Bitcoin has a history of volatility following record highs. With the Fed appearing less dovish than anticipated, the situation becomes more uncertain.”

Moreover, the decline is largely attributed to the expiration of over $3 billion worth of options for Bitcoin and Ethereum on March 15th. This event is known to introduce significant volatility into the crypto market.

The expiry of 30,568 BTC options, valued at $2.09 billion, was expected, with a put-call ratio of 0.79. Notably, the maximum pain point stood at $66,000. Despite a drop in BTC price to $66,770, still above the maximum pain point, this presented an opportunity for traders to capitalize on the dip.

Similarly, 332,094 ETH options, worth $1.24 billion, were set to expire, with a put-call ratio of 0.69 and a maximum pain point of $3,550. Ethereum traders, buoyed by bullish sentiments, reaped profits above this threshold, with ETH price dipping to $3,656 within 24 hours.

In addition, according to recent data from Lookonchain, a platform providing analysis of blockchain transactions and activities and deeper insights into market trends, observed a noteworthy occurrence that could have had an impact on the crypto market recently.

Why is #Bitcoin down 6.6% today?

— Lookonchain (@lookonchain) March 15, 2024

We noticed that a #Binance deposit wallet moved 4,637 $BTC($329M) to #Binance hot wallet in the past 24 hours.

Coincidentally, the deposit wallet also moved 4,876 $BTC($319M) to #Binance hot wallet during the $BTC drop on Mar 5. pic.twitter.com/EHEzGwV1U9

Bitcoin’s 6.6% decline today correlates with a substantial movement of 4,637 BTC ($329M) from a deposit wallet to Binance’s hot wallet within the past 24 hours. Interestingly, a similar transfer of 4,876 BTC ($319M) occurred during the BTC drop on March 5.

The movement of such a large amount of Bitcoin to Binance’s hot wallet suggests a potential correlation with the current price decrease. This activity raises questions about the intentions behind these transfers and their impact on market sentiment.

The Impact of Recent Crypto Market Dip

After a series of impressive gains, Bitcoin’s price has taken a sharp downturn, reaching a weekly low of $67,000. Ethereum, SOL, and BNB also experienced significant drops after reaching record highs. BTC plummeted from $74k to $67k, marking a notable decline. ETH and BNB followed suit, dropping by 7% to under $3,700 and $575, respectively.

According to data from Coinglass, these price fluctuations have led to over 190,000 traders being liquidated, with a total value of $683 million in wrecked positions. The largest liquidation occurred on OKX, totaling over $13 million.

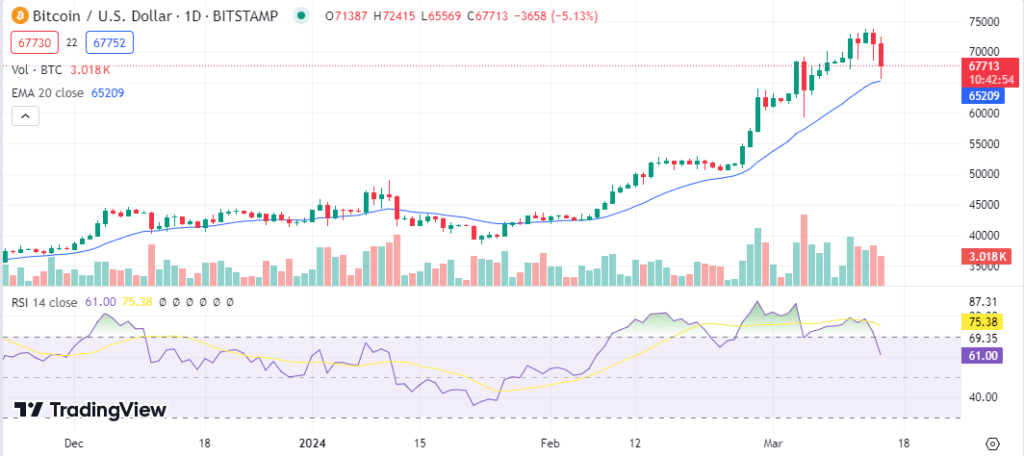

Bitcoin Technical Outlook

On the technical front, BTC displays a bearish reversal as most indicators diverge toward the negative territory. The Relative Strength Index (RSI) has dropped from the overbought region and currently hovers around the 60 index, suggesting a shift in market momentum.

BTC has dropped to the 20-day Exponential Moving Average at 65,209, indicating a sell signal. Furthermore, the Moving Average Convergence Divergence (MACD) indicator slowly heads toward the zero line as the green bars decrease on the histogram, indicating a rise in selling pressure.