Key Insights:

- Despite Bitcoin’s historic climb, muted discussions indicate attention is diverted to altcoin performances.

- A 15% drop in the average Bitcoin investment age in five months validates the ongoing bull cycle.

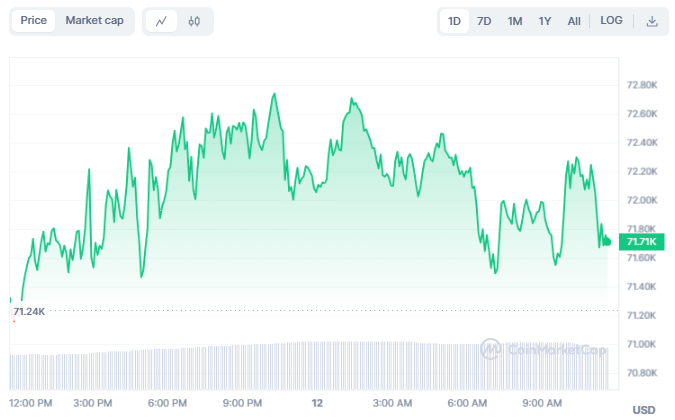

Bitcoin broke the $70,000 barrier over the weekend, marking a potential start to a series of new highs in the coming months. The prized digital asset is currently trading at $71.710, boasting gains of nearly 2% in the last 24 hours.

BTC/USD price chart: CoinMarket Cap

This rally is fueled by robust institutional interest in cryptocurrencies, signaling a growing shift towards digital assets. Bitcoin’s ascent continued, surpassing $72,000, and it is currently consolidating above $70,000.

The Fear and Greed Index reached an exceptional 67, indicating a sign of greed in the market. Ethereum has joined the upward trajectory, reaching the $4,000 milestone and contributing to the overall market surge, which now stands at a market capitalization of $2.69 trillion.

BTC’s price reached a new all-time high at $72,764, showcasing the strength of the ongoing bullish momentum. The current focus for BTC bulls is on breaching the $72,500 and $72,850 resistance levels, paving the way for a potential move towards $75,000.

However, a potential downside correction is imminent if Bitcoin fails to overcome the $72,500 resistance. Immediate support lies at $72,000, with a significant support base at $70,000. A close below this level could trigger a pullback towards the $68,500 range, potentially extending to $66,600.

According to data from Santiment, Bitcoin has marked a historic milestone, reaching an all-time high of $72,764. Notably, a surge in dormant coins returning to circulation serves as a key indicator of the ongoing bull market. Discussion on BTC, however, remains surprisingly subdued compared to its remarkable price performance. Intriguingly, this contrasts with the simultaneous strong performances of altcoins, diverting attention from the leading cryptocurrency.

Adding to the narrative, the average age of Bitcoin investments has swiftly dropped by 15% in under five months. This dynamic shift underscores the movement of dormant BTC into circulation, providing further validation for the current bullish cycle. Transitioning to altcoins, their robust performance influences the overall discourse, contributing to the modest discussions surrounding Bitcoin.

Bitcoin Technical Analysis

Looking at the BTCUSD 24-hour chart, the Relative Strength Index (RSI) registers an overbought rating of 78, signaling a potential correction for Bitcoin. However, the positive trend in the Moving Average Convergence Divergence (MACD) suggests ongoing optimism, possibly leading to further price increases before a correction.

BTC/USD chart: TradingView

While a correction may present a buying opportunity, the MACD’s positive region implies potential consolidation before a reversal. Traders should monitor the MACD crossing below the signal line for a shift in momentum toward a negative trend. Notably, the histogram maintains positive values, indicating a period of consolidation before a possible reversal.