Key Insights:

- Ethereum surpasses $2,800, driven by Bitcoin’s surge and anticipation for the first U.S. SEC-approved Ethereum ETF.

- Major financial firms show interest in Ethereum ETF, boosting its price with a 60% chance of approval by May.

- Technical indicators favor Ethereum, with RSI and MACD suggesting strong momentum towards the $3,000 resistance level.

Ethereum’s value is on an upward trajectory, maintaining a solid position above the crucial $2,800 mark. Given its current momentum, there is a strong indication that its value could climb towards the $3,000 mark.

This positive trend in ETH’s price is partly due to its close correlation with Bitcoin, which has recently surpassed the $52,000 threshold. This development has fueled optimism that ETH might reach the $3,000 level soon.

Ethereum’s ETF Sentiment

The surge in ETH’s price is not solely attributed to the technical benefits brought about by Staking on its network. Instead, it’s largely influenced by the overall positive sentiment towards Bitcoin’s rally and the optimism surrounding spot BTC ETFs.

The ongoing discussions about the potential approval of a spot Ethereum ETF have significantly contributed to this bullish outlook. Industry giants such as BlackRock, Grayscale Investments, and Fidelity Investments have shown interest, leading market analysts to estimate a 60% chance of an Ethereum ETF approval by May, coinciding with the deadline for VanEck’s application decision by the SEC. The introduction of an Ethereum ETF is expected to attract substantial institutional investment, further boosting ETH’s value.

Moreover, the competition to launch the first Ethereum ETF approved by the US SEC is heating up, with Franklin Templeton being the latest to submit an application. This competition is likely to keep investor interest in ETH high.

Ethereum Current Price Action

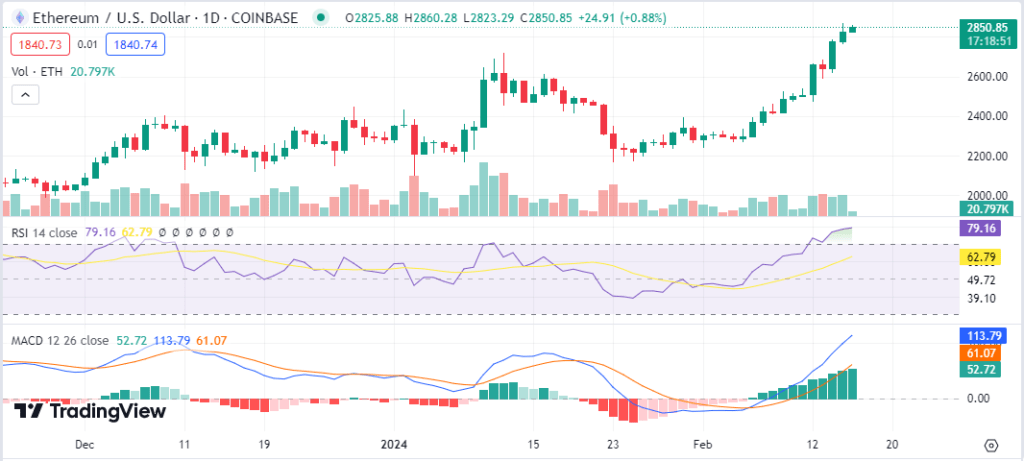

Regarding ETH’s market performance, the cryptocurrency has recently surpassed the $2,750 benchmark, moving past the $2,800 resistance level and even briefly exceeding $2,850. However, it faced a slight pullback, similar to Bitcoin, after reaching a multi-week peak of $2,860. As of this writing, ETH is trading at $2,850, up by 2.20% on the daily chart, while the weekly gain has peaked at 16%.

The immediate resistance level is identified near $2,860, followed by significant resistance at $2,900 and then at $2,950. A break above these levels could see ETH testing the $3,000 mark and potentially reaching as high as $3,100, with a further possible increase to the $3,200 level.

Ethereum might undergo a corrective dip if it struggles to overcome the $2,860 resistance. The initial support is found near the $2,820 level, followed by crucial support at $2,780. A breach below this could lead the value down towards the $2,720 mark, with the main support at $2,700. A continued decline could push prices towards the $2,600 threshold.

Ethereum Technical Outlook

Looking at the technical indicators, ETH exhibits a strong bullish outlook. The Bulls have led, overthrowing the sellers amid minor pullbacks. The Relative Strength Index (RSI) indicates a potential minor pullback due to the overbought condition. However, sustaining above the $2,800 level could give ETH the necessary momentum to aim for the $3,000 threshold.

Moreover, the Moving Average Convergence Divergence (MACD) indicator is positive as the MACD line climbs further above the signal line, suggesting a strong bullish momentum. The histogram paints a bullish picture as the green bars form and climb higher.