Key Insights:

- Bitcoin’s value exceeds $1 trillion, fueled by a 21% increase this year and substantial ETF inflows.

- Bitcoin ETFs attract over $2 billion in 4 days, marking a significant boost in investor confidence

- Technical indicators suggest a strong bullish momentum for Bitcoin, with potential corrections due to overbought conditions.

The market value of BTC has recently surged past the $1 trillion milestone, driven by heightened interest from investors and a notable increase in investment. The digital currency hit a peak not seen in over two years, reaching $52,467, largely thanks to significant capital inflows into Bitcoin ETFs in the U.S. market.

Despite a temporary decline to below $50,000 following unexpectedly high U.S. inflation figures, the market’s confidence in Bitcoin remained strong, quickly recovering. So far this year, Bitcoin’s value has escalated by over 21%.

Table of Contents

ToggleBitcoin Current Price Action

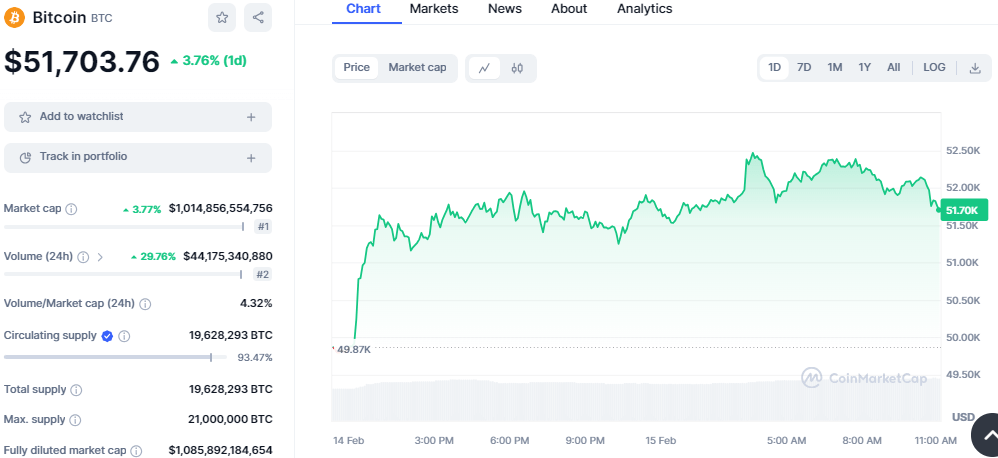

As of this writing, BTC is trading at $51,703, up by over 3% in the daily timeframe, while the weekly gain is 17% as per coinmarket cap data. BTC has been trading above the $52k threshold for most of today’s session as the surge in the trading volume continues. The 24-hour trading volume has increased by almost 29% while the market capitalization remains above the 1Trillion mark.

Looking at the resistance and support levels, BTC will likely break above the immediate resistance at $52,500 if the current trend holds. A break above this mark could pave the way for new resistance levels at $54k and $55k. However, a shift in the current market dynamics could see BTC retrace toward the $50k level, and a break below this level could lead to a retrace of the key support level at $47,500.

What is Driving Bitcoin Up?

Several factors contribute to BTC’s upward trajectory, notably the inflow into ETFs. In the span of just four days, Bitcoin ETFs have attracted more than $2 billion in new investments. The previous day alone saw an influx of $631 million, marking the largest single-day investment since its inception. This demand was 14 times greater than the amount of BTC produced that day.

Such significant ETF inflows not only bolster the market sentiment for BTC but may also positively influence the outlook for Ethereum ETFs. Notably, over 70% of the new capital invested in Bitcoin has come from these spot ETFs in the past two weeks, underscoring their increasing influence on the market.

The anticipated halving event in April is also a key factor to watch. This event, which occurs every four years, cuts the supply of new Bitcoin by half, potentially driving up its price due to the resultant scarcity. Past halving events have led to substantial price rallies for Bitcoin, and market analysts predict the upcoming event may follow a similar pattern.

Bitcoin Technical Outlook

Bitcoin’s technical front paints a strong, bullish outlook. Indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) have climbed steadily northwards, supporting the current uptrend. The RSI is at an elevated level of 80 index, indicating an overbought region, which could however lead to correction in the coming sessions.

The MACD indicator is climbing higher above the signal line, which suggests a rise in buying pressure as the buyers take the lead. The histogram forms a series of green bars in the positive region, indicating a strong bullish momentum that could push the price higher. In addition, most Moving average oscillators reflect buy signals as the price hovers above them.