Key Insights:

- Market corrections present buying opportunities asserts a crypto analyst, urging investors to capitalize on Bitcoin’s dip.

- The analyst predicts a period of consolidation for Bitcoin, emphasizing the importance of strategic buying amid market shifts.

- The analyst identifies Bitcoin’s area of interest as ranging between $56,000 to $60,000, reiterating his stance that “dips are for buying in these markets.”

Bitcoin and Ethereum Lead Cryptocurrency Market Recovery Amidst Volatility

The cryptocurrency market has witnessed a surge in activity lately, with Bitcoin and Ethereum leading the charge in a notable recovery. This resurgence arrives as a welcome relief following the recent market dip. As the much-anticipated Bitcoin halving event looms closer, scheduled for April 19, market fluctuations are underway, with many interpreting the current phase as a necessary correction before a more definitive trend emerges.

Amidst recent developments, Bitcoin’s price experienced a sharp downturn, dipping below the $67,000 mark, prompting concerns among stakeholders. However, a prominent crypto analyst has seized the moment to encourage the community to seize this opportunity and acquire more BTC at a discounted price.

The trajectory of Bitcoin over the past months portrays a notable rebound, with the asset hitting a peak of $73,800 on March 14. Nonetheless, a recent retreat has been observed, with BTC’s value retracting by 10%, showcasing the inherent volatility of the market and its susceptibility to swift fluctuations.

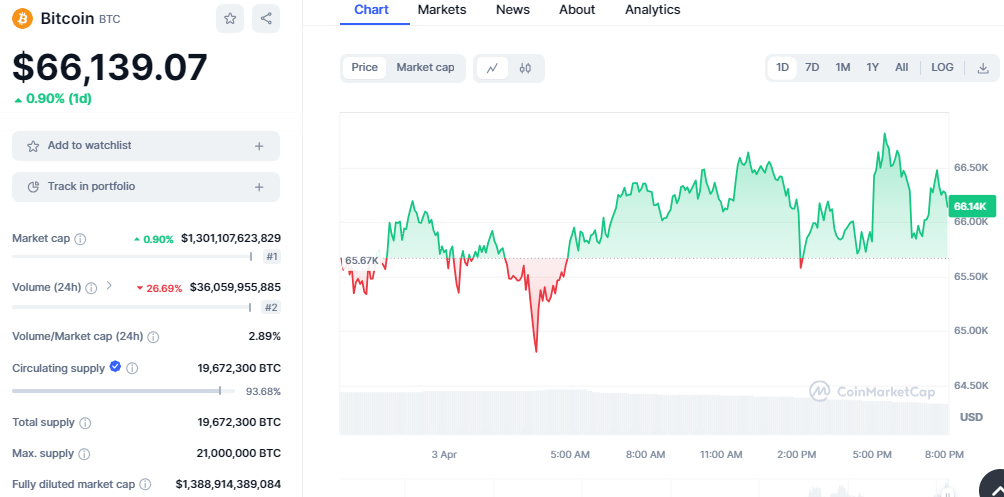

As of this writing, BTC is exchanging hands at $66,139 up by 0.90% in the past 24 hours. The market capitalization is standing at $1.3 trillion, while the trading volume displays a decline of 26% with a value of $36 billion.

BTC/USD price chart: CoinMarket Cap

Analyst Encourages Purchases Amidst Market Corrections

In a recent post on social media platform X, prominent crypto analyst Michael van de Poppe expressed optimism regarding Bitcoin’s future trajectory, urging investors to view the recent price dip as an opportunity to accumulate the cryptocurrency.

According to Poppe, the crypto market regularly experiences both bullish and bearish movements, contributing to its overall balance and stability. He emphasized that price corrections are typical in the crypto space, irrespective of market conditions.

Poppe’s encouragement to buy more BTC comes amidst a recent 4% decline in the cryptocurrency’s value over the past week. Despite this, he remains steadfast in his belief that current market conditions present a favorable opportunity for investors.

“At peak bullish momentum, you’ll see a huge impact of every bearish narrative. This time, it’s the Silk Road Bitcoin being transferred. Anyway, buy the dip,” stated Poppe.

Van de Poppe further cautioned about a critical price zone loss for Bitcoin and expressed skepticism regarding a surge to new all-time highs before breaking through resistance levels at $69,000.

He anticipates a consolidation phase for BTC, suggesting that altcoins might gain traction during this period. Van de Poppe remarked, “A price correction for Bitcoin indicates a healthy and organic market cycle.”

Bitcoin Price Analysis

Bitcoin’s price has experienced a downturn, slipping beneath the crucial $65,000 support zone. Currently, BTC is consolidating its losses and may aim for a recovery towards the $67,000 mark.

Following the breach of the $68,000 support level, Bitcoin’s price entered negative territory, descending below $65,500 and eventually touching $64,572. Presently, it’s stabilizing losses with some movement above the $65,000 threshold. Currently, Bitcoin is trading below $67,000 and the 100-hourly Simple Moving Average (SMA). On the hourly chart, a significant bearish trend line is emerging, indicating resistance near $67,200.

Immediate resistance stands at approximately $66,000, with the primary hurdle anticipated around $67,200 along with the trend line. A decisive breakthrough above this resistance could initiate a fresh upswing. Subsequently, the $68,500 level presents a significant barrier. Further advancement might propel Bitcoin towards the $70,000 resistance in the near term.

However, failure to surpass the $67,200 resistance may prompt continued downward movement. Initial support lies near $65,200, with $64,500 being a significant level following that. Should Bitcoin’s descent persist, the $64,000 mark becomes pivotal, potentially leading to a decline towards $62,500. Further losses could drive the price towards the $60,500 support zone in the immediate future.

Bitcoin Technical Analysis

Looking at Bitcoin’s technical front, BTC is trading on a bearish outlook. Several indicators have dropped toward the negative territory. The Relative Strength Index (RSI) indicator has dropped to the neutral level, suggesting a shift in market dynamics. The buying pressure needs to increase to elevate the RSI toward the overbought region again.

BTC/USD chart: TradingView

The Moving Average Convergence Divergence (MACD) indicator displays a bearish trend as the MACD line heads toward the zero line. Currently, the MACD line is placed below the signal line, and the histogram prints red bars.