Key Insights:

- Bitcoin’s recent peak at $57,416 marks a significant milestone, driven by MicroStrategy’s substantial investment, signaling strong market confidence.

- The introduction and performance of spot Bitcoin ETFs, particularly BlackRock’s ETF, underscore the growing institutional interest in cryptocurrency.

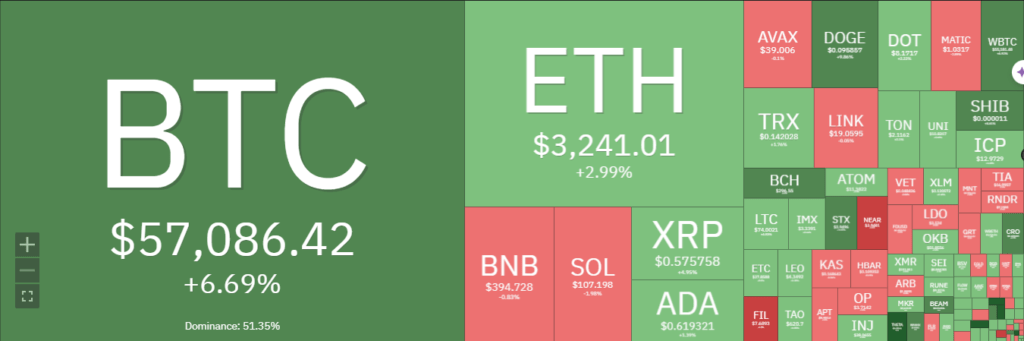

- Bitcoin’s 6% price rise in the past 24 hours, with a trading volume of $52.8 billion, underscores its expanding attractiveness and liquidity in the market.

Bitcoin experienced a significant breakthrough, surging above the $57,000 mark. This surge, a two-year high, grabbed the attention of both enthusiasts and skeptics. MicroStrategy’s recent investment played a crucial role in this rally. They invested $155 million in BTC, acquiring about 3,000 tokens. This move increased their BTC holdings to a value exceeding $10.5 billion.

Additionally, the ripple effect of Bitcoin’s surge impacted the broader crypto market. Ethereum, for example, reached its highest price in months. In the United States, stocks related to cryptocurrencies also saw remarkable gains. Companies like MicroStrategy and Coinbase showcased impressive financial performance, catching the eye of investors.

The spotlight also shines on the performance of newly launched spot BTC exchange-traded funds (ETFs). These funds, nine in total and excluding Grayscale’s GBTC fund, now manage nearly 1.5% of Bitcoin’s total supply. Their assets under management (AUM) reached a notable milestone, with 303,002 BTC valued at around $17 billion.

This development indicates a significant interest in BTC from institutional investors. BlackRock’s IBIT Bitcoin ETF leads these funds, holding over 128,000 BTC. Fidelity’s FBTC comes in second, with more than 94,000 BTC in its possession. This interest starkly contrasts with Grayscale’s GBTC fund, which saw a 28% reduction in holdings since it began trading.

Recent market analyses have shown remarkable achievements in the Bitcoin space, with a notable report from a top market research firm indicating that 95% of BTC addresses are now in profit. This figure echoes the heights reached in the 2021 bull market, a period when Bitcoin’s value climbed to new highs above $60,000.

As of the time of this writing, Bitcoin’s price has increased by 6% over the last 24 hours. The trading volume during this period was $52.8 billion, highlighting the cryptocurrency’s growing appeal and liquidity in the market.

BTC/USD price chart: CoinMarket Cap

Bitcoin has surpassed a critical threshold that had acted as a barrier for the past two to three years. This breakthrough suggests that the final significant obstacle remaining is the previous cycle’s peak of $68,000, hinting at the possibility of continued growth.

Current technical analysis suggests caution despite strong market momentum. The Relative Strength Index (RSI), standing at 80.95, indicates that BTC may be overbought, raising the likelihood of a near-term correction.

BTC/USD Chart: TradingView

Meanwhile, the Moving Average Convergence Divergence (MACD) underscores the robust bullish trend. However, the elevated RSI level advises traders to watch for potential market retracement.