Key Insights:

- Bitcoin’s rally halts as it hovers around $52,000, with market analysts closely watching key support and resistance levels.

- Nearly 848,390 Bitcoin addresses face losses after purchasing at an average price of $52,125, increasing the potential for a significant sell-off.

- Bitcoin shows signs of an impending correction, with RSI above 70 and MACD indicators pointing to increased selling pressure.

Bitcoin experienced a remarkable surge in value throughout February, breaking through the significant $50k barrier and reaching new heights. However, after peaking at $52,900 mid-month, its highest value since late 2021, the cryptocurrency’s momentum showed signs of waning.

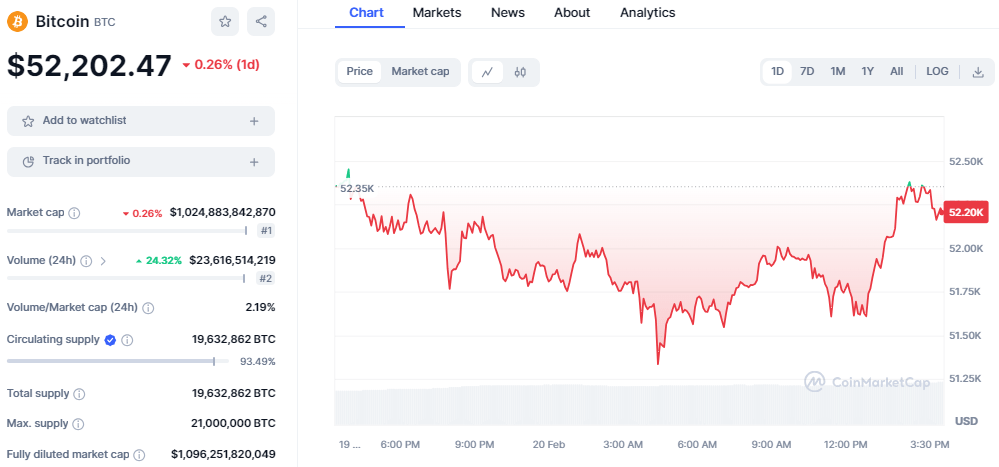

Over the past few days, BTC’s price struggled to advance over the past few days, dropping to $50,500 before recovering slightly. Despite attempts to regain lost ground, it failed to achieve a significant breakthrough, sliding back under the $52,000 mark. As of this writing, BTC is exchanging hands at $52,202, down by 0.26% on the daily timeframe.

BTC/USD price chart: CoinMarket Cap

This Bitcoin price fluctuation reflects a broader volatility trend in the cryptocurrency market. Despite maintaining a market capitalization above $1 trillion, BTC’s dominance has gradually decreased, now standing at 51.6%. This shift indicates a growing interest in alternative cryptocurrencies, even as BTC faces challenges sustaining its upward trajectory.

Market analysts, including renowned crypto expert Ali Martinez, have closely monitored Bitcoin’s short-term price movements. Martinez points to the critical support and resistance levels of $51,700 and $52,515, respectively, as key indicators of BTC’s immediate future. The TD Sequential indicator, a tool traders use to predict price movements, suggests that a sustained close outside these levels could significantly influence Bitcoin’s direction.

On #Bitcoin 10-mins chart, the TD Sequential’s support trendline sits at $51,700 while the resistance trendline is at $52,515. A sustained close outside of this zone will determine the direction of $BTC next move. pic.twitter.com/D0awMEQTxp

— Ali (@ali_charts) February 19, 2024

Furthermore, according to data from Lookonchain shared by Into The Block reveals that a substantial number of Bitcoin addresses, having purchased around 481,710 BTC at an average price of $52,125, are currently incurring losses. This situation has led to speculation about a possible sell-off, which could exert downward pressure on Bitcoin’s price, potentially driving it below the $50,000 threshold.

Data from @intotheblock shows that 848.39K addresses bought ~481.71K $BTC($25B) at an average price of $52,125.

— Lookonchain (@lookonchain) February 20, 2024

These addresses are currently at a loss and may generate selling pressure when their positions reach breakeven.https://t.co/DsTpEwOO9b pic.twitter.com/87Rthk8wGC

In addition to individual investors, the options market has shown remarkable activity, with Bitcoin’s open interest surpassing $10 billion for the first time since July 2022. This surge in open interest reflects a growing enthusiasm among investors, though it also raises concerns about the sustainability of the current price levels.

As Bitcoin navigates this period of uncertainty, investors and analysts alike remain vigilant, closely observing market indicators and trends. The cryptocurrency’s ability to maintain its value above key support levels will determine its path forward. With the potential for increased selling pressure and market fluctuations, the coming weeks will be critical for Bitcoin’s trajectory.

Bitcoin’s technical outlook displays a bullish outlook, shifting momentum as bearish activity takes hold. Amid most of the indicators displaying a buy signal, BTC could face a minor correction in the coming sessions if the selling pressure continues.

The Relative Strength Index (RSI) indicator is currently hovering above the 70 index, suggesting that the trend is overbought and BTC could be imminent for a price correction. The Moving Average Convergence Divergence (MACD) indicator is losing its positive trajectory as it slopes toward the south, and the green bars fade away in the histogram, suggesting the selling pressure is increasing.

Read also:

Worldcoin soars 140% in a week as wallet app hits 1M daily users

Bitcoin Rise Above $52k: Factors Fueling BTC’s Impressive Market Rally

Surging Ethereum Breaks $2,800, Sets Sights on $3,000 With ETF Buzz