Key Insights:

- Bitcoin’s fight to break the $70,000 resistance highlights its recovery effort, underpinned by strong support above $67,000.

- Whales have amassed over 319,310 BTC in Q1 2024, showcasing strong confidence in Bitcoin ahead of the anticipated halving event.

- Bitcoin’s performance has skyrocketed, with a 50% increase since 2024, buoyed by the introduction of spot Bitcoin ETFs and institutional interest.

Bitcoin has taken the lead in a modest revival of the cryptocurrency market, pushing toward the $70,000 mark. This resurgence aims to overcome recent declines and set new benchmarks. The digital currency market has seen a turnaround this weekend, with BTC at the helm.

The beginning of 2024 marked a significant period for BTC, primarily due to the introduction of spot Bitcoin ETFs. This move significantly attracted institutional investors, propelling Bitcoin’s value by more than 50% from the start of the year despite a drop to the $67,000 level.

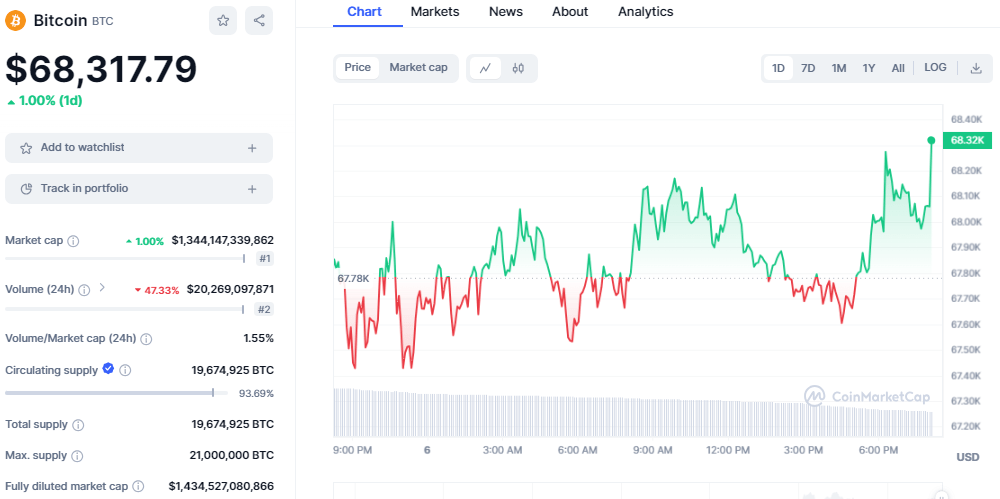

As of press time, BTC was trading at $68,317, up by 1.16% in the past 24 hours. BTC has been forming higher highs and lower highs on the daily chart as bullish momentum builds. The market cap has climbed to the $1.3 billion mark, while the daily trading volume has seen a significant drop of 47% with a value of $20 billion.

BTC/USD price chart: CoinMarket Cap

Bitcoin Price Analysis

BTC is navigating crucial resistance levels as it aims to secure a position above the $69,000 mark. Currently trading beyond $68,000, BTC encounters significant obstacles near the $69,500 and $70,000 thresholds. However, its resilience above the $67,000 support zone sparks hope for a continued upward movement.

The recent upswing began when Bitcoin found solid footing around $67,000, propelling it past resistance points at $67,500 and $68,000. This momentum carried Bitcoin to peak briefly over the $68,200 mark, setting a recent high at $68,300. At present, BTC is consolidating these gains, indicating a potential for a further increase if it maintains above the pivotal $67,000 support.

Immediate resistance looms near $68,300, with a significant barrier at $68,500. The critical milestone, however, is the $70,000 resistance zone. A decisive breach above this level could ignite a fresh surge towards $71,000, with subsequent resistances waiting at $72,000 and potentially $73,500.

Conversely, failure to overcome the $68,300 resistance could trigger a retracement. Initial support lies around $67,300, closely followed by a major support level at $67,000. Further support is identified at $66,500, with a breach below $66,000 possibly leading to declines towards $65,500 and even $64,500 in the near term.

Bitcoin Technical Analysis

Looking at the technical analysis, BTC displays a price recovery as most indicators swing toward the upper side. The Chaikin Money Flow (CMF) indicator holds just above the neutral line at 0.09, suggesting a balance between buying and selling pressure. The Exponential Moving Average (EMA) over a 20-period close shows a figure of $67,611, serving as a dynamic support that Bitcoin’s price has managed to uphold.

BTC/USD chart: TradingView

In addition, the Moving Average Convergence Divergence (MACD) shows burgeoning bullish sentiment. The MACD line (blue) crossing over the signal line (orange) is a classical bullish indicator that traders might interpret as a favorable time to enter the market, anticipating further gains.

The Relative Strength Index (RSI), a momentum oscillator that measures the speed and change of price movements, is currently positioned at 55, reflecting neither overbought nor oversold conditions. This level of the RSI often points to a potential for either trend continuation or reversal, depending on incoming market signals. The subtle crossover of the RSI line above the midline hints at increasing momentum.

Whales Accumulate Bitcoin Ahead of Key Supply Cut

As for today’s crypto landscape, BTC maintains its position above $68,000. Ethereum, on the other hand, has climbed past the $3,300 threshold. With the fourth Bitcoin halving event drawing near, which will slash miner rewards from 6.25 BTC to 3.125 BTC, there’s a keen interest in the currency’s next direction.

This halving is poised to induce a supply shock, a factor well-understood by Bitcoin whales. These significant stakeholders have bolstered their holdings with an additional 319,310 BTC in the first quarter of 2024, accounting for roughly 1.4% of Bitcoin’s total supply. This accumulation contrasts with the selling trend observed among smaller wallet holders, who have reduced their holdings by 105,260 BTC.

This strategic accumulation by whales signals a bullish outlook for Bitcoin and the broader cryptocurrency ecosystem. It reflects robust confidence in Bitcoin’s value proposition, especially as the halving event approaches on April 19th.

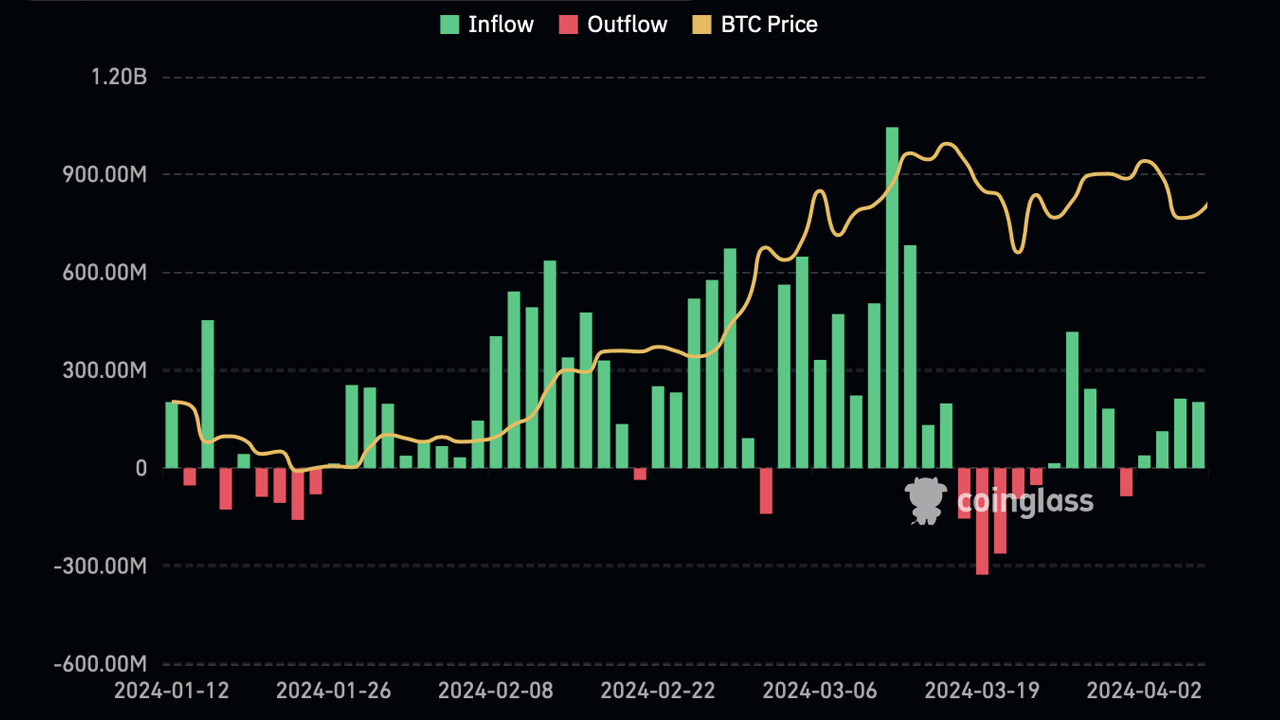

Bitcoin ETFs Rebound Strongly with $569.4 Million Weekly Inflows

After an initial stumble at the start of April, experiencing a $84.7 million outflow, US-based spot Bitcoin exchange-traded funds (ETFs) swiftly recovered. They have since captivated the market’s attention by amassing $569.4 million in net inflows. The remarkable turnaround commenced on April 2, with the funds attracting $39.5 million, and the momentum only grew stronger. By April 3, inflows had surged to $213.4 million, culminating in a $203 million influx on Friday, as per coinglass statistics.

Total Bitcoin Spot ETF Net Inflow: Coinglass

Despite this upward trajectory, Grayscale’s GBTC faced the largest single-day outflow among its peers. Yet, Friday’s overall trading volume, although reduced by 31.5% to $2.37 billion from the previous day’s $3.46 billion, barely impacted the inflow’s pace, marking only a slight decrease of 4.87% from Thursday.

Following Friday’s activities, Grayscale’s fund holds a substantial 325,686.78 BTC. Not far behind, Blackrock’s IBIT and Fidelity’s FBTC also reported positive inflows, with holdings now at 259,381.18 BTC and 149,339 BTC, respectively. This indicates not just a recovery but a thriving interest across a variety of Bitcoin ETFs.

This rebound is especially noteworthy against the backdrop of April’s shaky start in crypto spot markets. The eleven US-based Bitcoin ETFs, despite experiencing some volatility and outflows, closed the week on a high note. This reflects a resilient optimism in the market, with consistent inflows across four consecutive days highlighting the enduring appeal of Bitcoin investments.