Key Insights:

- Ethereum’s price trajectory is fraught with challenges, facing resistance near $3,500 while the $3,200 support level remains key for recovery.

- Ethereum’s recent drop below the 50-day SMA at $3,424 opens the risk of revisiting lower levels, hinting at a bearish market sentiment.

- SEC’s public comment invitation for Ethereum ETFs reflects standard protocol, not necessarily a bullish signal for approval.

Ethereum, the 2nd largest cryptocurrency, is currently weathering a storm in the volatile market. Recent downturns in Bitcoin’s value have impacted ETH, pushing it down towards $3,200. Efforts to breach the $3,650 resistance were in vain amid prevailing market uncertainties, causing investor unease. A strong rejection at the $3,550 mark led to a sharp fall to $3,200, testing vital support levels.

However, the $3,200 support could herald a turnaround for Ethereum, with current prices slightly above $3,280. Nevertheless, ETH’s journey upward faces obstacles, notably below the $3,500 threshold. Immediate resistance lies at $3,370, with significant challenges at $3,400 and $3,500. Overcoming these could significantly lift Ethereum’s price, eyeing $3,700, provided it can conquer $3,800.

Short-term outlooks are less optimistic. Failure to move past $3,370 might signal further declines, potentially retesting the $3,200 support. Dropping below this could lead to a deeper fall toward $3,100 or even the $3,000 mark. This delicate balance underscores the critical nature of the $3,200 support level in Ethereum’s path to recovery amidst ongoing market fluctuations.

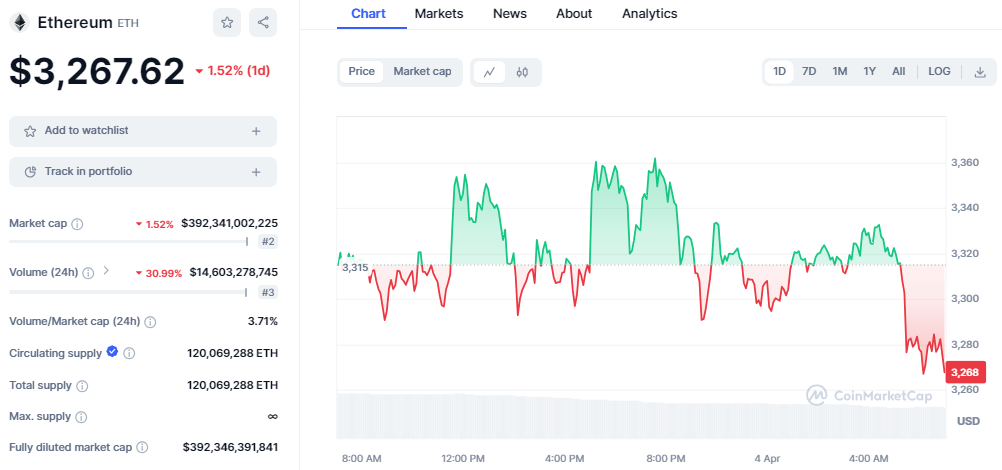

As of press time, ETH is trading, exchanging hands at $3,267, down by over 1% on the daily timeframe. Over the past week, ETH has lost over 6% of its gains, while the monthly chart shows a decline of 5%. The market cap and trading volume are on the decline, recording a 1.52% and 30% decrease, respectively, with their values standing at $392 billion and $14 billion.

ETH/USD price chart: CoinMarket Cap

Table of Contents

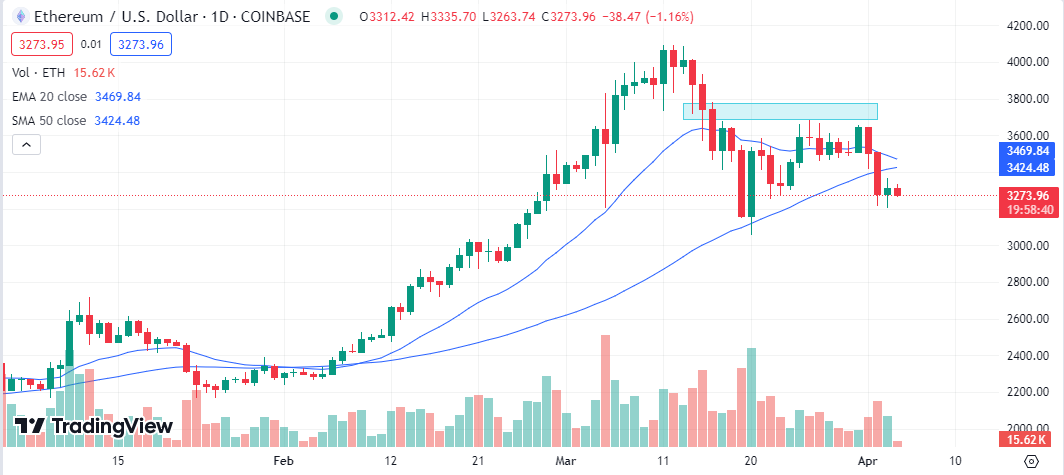

ToggleEthereum Technical Analysis

On April 2, Ethereum witnessed a significant downturn, breaching the 50-day Simple Moving Average (SMA) of $3,424. This move has heightened concerns of a possible retest of the previous low at $3,056. The 20-day Exponential Moving Average (EMA) trending downwards and the Relative Strength Index (RSI) positioning just below the midpoint further affirm the bearish grip on the market.

ETH/USD chart: TradingView

Moreover, the Moving Average Convergence Divergence (MACD) indicator echoes the bearish outlook with predominant red bars and the MACD line below the signal line, indicating the sellers’ stronghold remains unchallenged.

Should Ethereum’s price slide below $3,056, an intensified sell-off could ensue, potentially driving the ETH/USDT trading pair down to $2,700. This scenario has investors on edge as they ponder the market’s next move.

To counter this downward momentum, bulls face the task of reclaiming ground above the moving averages. Achieving this would suggest a transition to range-bound trading between $3,056 and $3,670. A decisive climb above $3,670 would signal a bullish resurgence, potentially elevating the pair towards the $4,000 mark.

Ethereum ETF Applications Spark SEC Request for Community Input

The U.S. Securities and Exchange Commission (SEC) has officially opened a period for public commentary concerning three Ethereum spot ETF proposals. This step involves applications from Grayscale Investments, Fidelity, and Bitwise. The SEC published this request in a bid to involve the public in its decision-making process, setting a 21-day window for feedback.

This development arrives at a time of mixed sentiment within the cryptocurrency industry. Earlier approvals for Bitcoin spot ETFs had sparked a wave of optimism. Yet, many remained cautious about Ethereum’s chances. Despite this, the SEC’s recent actions, including the opening of these applications to public comment, indicate a systematic approach to evaluating each proposal on its merits.

SEC Chairman Gary Gensler previously clarified that the commission’s approval of Bitcoin ETFs should not automatically extend to other cryptocurrencies. This stance underscores the SEC’s careful and distinct evaluation of each digital asset. Following the landmark Bitcoin ETF approvals, investment in Bitcoin surged. Now, there is speculation on whether Ethereum will witness a similar trend if it receives the green light from the SEC.

The deadline for the SEC’s final decision on some of these Ethereum ETF applications is set for May 23. Despite the procedural nature of the public comment request, the crypto community views this period as a critical time for Ethereum’s potential market expansion.

Analysts, while observing the SEC’s request for comments, remain measured in their optimism. The process, as Bloomberg ETF analyst James Seyffart notes, is a routine part of evaluating ETF filings, whether they are ultimately approved or rejected. Additionally, the approach of the May deadline has not significantly lifted expectations for immediate approval.

Apparently there's a lot of people that need to hear this:

— James Seyffart (@JSeyff) April 3, 2024

Asking for public comments on a 19b-4 is standard procedure. Every single 19b-4 ETF filing goes through the same process (whether approved or denied) It's not "bullish" in any capacity for #Ethereum ETFs

That is all. pic.twitter.com/fbKMIQbSbC

Moreover, the recent SEC investigation into the Ethereum Foundation has added a layer of complexity to the situation. Despite these challenges, some industry voices, like Bitwise Chief Investment Officer Matt Hougan, suggest that a delayed decision on Ethereum ETFs could ultimately benefit the market. He argues that traditional finance sectors may need more time to adapt to Bitcoin, let alone Ethereum.