Intraday trading refers to a trading style where traders open and close their positions within a day, generally not holding any trades overnight. This trading approach is an ideal way to acquire quick returns by capitalizing on short-term price movements of securities. Generally, it works best on volatile and liquid assets that can manifest significant action in a limited period. Moreover, day trading is believed to be more effective if a trader works on shorter time frames; however, the risks would increase correspondingly.

That being said, if you have a penchant for day trading, firstly determine your trading attitude, risk appetite, and ultimate objective. As day trading calls for a continuous monitoring of charts, substantial concentration, and quick decision-making power, you should get started with it only after careful consideration.

Hence, before moving to the main topic, let us look at some critical points you should keep in mind while day trading.

5 essential tips to remember during intraday trading

- Apply strict risk management. Cutting the losses timely is extremely important for scalpers and day traders to remain profitable in the long run.

- Adhere to your trading plan. Set the trade entry or exit triggers and follow the drafted rules.

- Be up-to-date with the latest financial happenings and events. Don’t miss out on the fundamental factors that can affect your technical analysis.

- Keep your emotions in check. An excessively emotional demeanor can be detrimental to your trading.

- Remember that no strategy can offer a 100% win rate. Try to manage your risk/reward ratio in order to remain profitable even with a 50%-60% win rate.

5 best intraday trading strategies

Days traders implement a number of strategies involving candlestick patterns, price action, and technical indicators adjusted to their unique trading disposition. Here are five time-tested intraday trading strategies you can consider for your market endeavors.

1. Bounce from support or resistance levels

One of the best intraday strategies for beginners is range trading, where traders identify the support and resistance zones for placing orders. However, this technique is only viable in non-trending or choppy markets when the price fails to breach pivot levels.

As the support area indicates a significant bullish pressure, “buy” orders can be placed there if the market respects this previously-maintained level. Similarly, the resistance zone offers “sell” opportunities, assuming the price could not break above the belt.

Also, managing risk in these setups is quite easy as you can position the stop-loss orders just below or above the key zones.

For further clarification, look at this 15-minute NZD/USD chart displaying a ranging market. Note that various short-term buy/sell opportunities can be seen here, specifically ideal for day traders.

2. RSI strategy – overbought and oversold areas

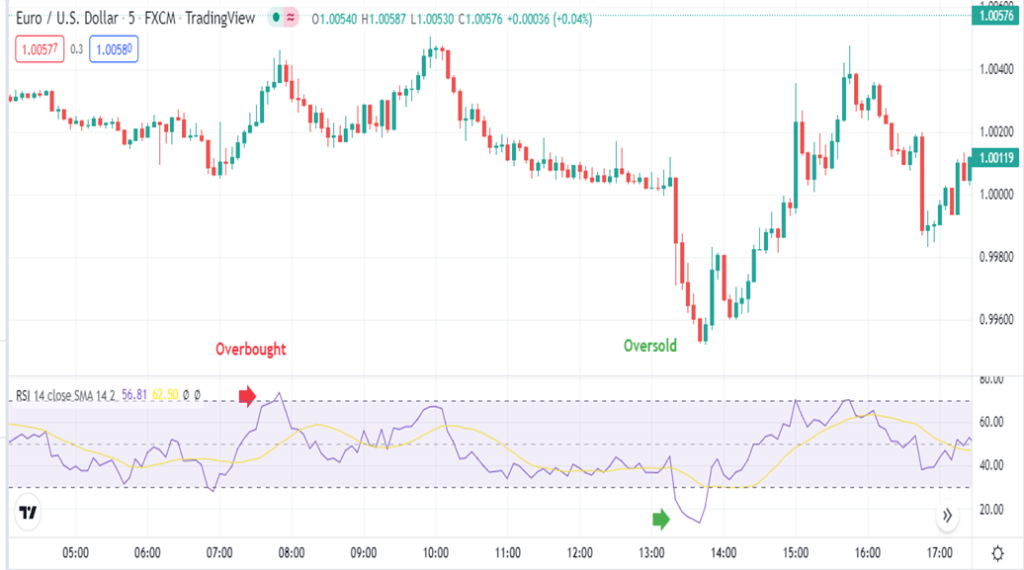

RSI (relative strength index) is the most commonly utilized technical oscillator that measures the speed and fluctuation of price via a scale of 0-100. Traditionally, the market is termed overbought when the RSI reaches above 70, whereas it is considered oversold below 30.

Combined with price action techniques, RSI offers several high-quality trading setups. The overbought RSI gives a “sell” signal, whereas the oversold RSI stipulates an imminent “buy” opportunity. In the EUR/USD chart below, you can see the instances when RSI touched the overbought and oversold zones.

3. Breakout strategy

Breakout refers to a market occasion when the price breaks through preceding key levels. When the price successfully moves past and retests the supply/demand belt, it is deemed to have “broken out.” As support and resistance are dynamic regions, they can be cracked anytime if the market players decide to push forward.

Breakout trading is a great way to exploit the freshly increased market volatility developed due to the evolving trend.

To illustrate, the following XAU/USD chart (1 hour) exhibits a bearish breakout setup. Here, the price has moved past the ranging zone in the downwards direction, finalizing the next market direction. Moreover, the price has also “retested” the breakout, providing further confirmation to the sellers.

4. Reversal strategy

Market reversal provides the participants with lucrative opportunities to catch an emerging trend from the very start.

Reversals can mostly be identified by examining candlestick patterns and technical indicators. Price formations like head & shoulders and triple/double peaks are some of the most common and reliable reversal patterns. In addition, assessing these arrangements with analytical tools like RSI can further verify the credibility of a setup.

For instance, when a trend is reversing, the relative strength index mostly begins losing steam and creates a divergence. In the below GBP/USD chart (30-minute), you can see that the price has hit the resistance level three times, enacting a triple top reversal pattern. Moreover, note that the RSI corresponding to 2nd and 3rd peaks is sloping down, indicating the gradual weakness of buyers.

5. Momentum and trend trading

Momentum or trend trading strategy is one the simplest intraday strategies for beginners, based on “following the powerful price movements in one direction.”

The market course can be easily identified by zooming out the charts or looking at larger time frames. Moreover, trends can be highlighted by drawing trend lines or applying moving averages that act as a dynamic support/resistance.

If the price consistently moves upwards, you can ride the bullish wave by entering on every swing back. Similarly, if the price moves in a bearish trend, you can enter in “sell” trades on every reliable pullback.

In the following EUR/USD chart, you can easily identify an upward trend where the price is bouncing from the two applied EMAs, 50-period, and 100-period. Every price rejection from the MAs offers suitable entry spots for entering “buy” positions.

Closing thoughts

Financial markets are driven by a plethora of catalysts, including the macroeconomic environment, geo-political events, and traders’ sentiments, among many others. In the light of such erratic conditions, trading involves a certain level of risk, and the markets could sporadically move anywhere anytime, sometimes neglecting all technical rules.

Consequently, to remain successful in this domain, you must carefully adopt a trading strategy well matched to your personal style. Although no trading scheme is completely “perfect” and may or may not work under certain conditions, you can still devise a ‘convenient strategy’ by rigorous backtesting or practicing to attain optimal results.

You may also like:

https://thetradingbay.com/best-forex-chart-patterns/

https://thetradingbay.com/what-is-price-action-trading-the-ultimate-price-action-trading-guide/