Key Insights:

- Dogecoin’s price drop to $0.08437 signals a struggle within the altcoin market, potentially affecting its position among top cryptocurrencies.

- Despite a decrease in Dogecoin’s open interest, large transaction activities suggest continued investor interest and potential for future growth.

- Ali Martinez’s analysis suggests Dogecoin mirrors pre-2021 bull run patterns, potentially setting the stage for a significant price rally.

Dogecoin has recently encountered a notable downturn in its market performance, leading to its exit from the ranks of the top ten highly capitalized cryptocurrencies. The token’s price has decreased by 0.57%, settling at $0.08437. Though not drastic, this slight dip underscores a period of underwhelming performance within the broader altcoin market.

DOGE/USD price chart: CoinMarket Cap

Additionally, Dogecoin has faced challenges in maintaining its growth momentum, with a potential breakthrough above $0.087 seen as critical for its upward trajectory toward $0.095. Conversely, failure to overcome this resistance could result in a decline to $0.080.

Ali Martinez, a renowned cryptocurrency analyst, has recently shared insights suggesting Dogecoin might be on the verge of a major market movement. According to Martinez, DOGE’s current price action closely resembles the patterns observed before its extraordinary bull run in 2021. Back then, Dogecoin’s value skyrocketed by an impressive 28,770% after breaking out from a descending triangle and entering a consolidation phase.

The price action of #Dogecoin is showing familiar patterns reminiscent of its 2020 behavior. Back then, $DOGE broke out from a descending triangle, entered a period of consolidation, and then skyrocketed by 28,770%.

— Ali (@ali_charts) February 23, 2024

Currently, #DOGE appears to be mirroring this pattern: having… pic.twitter.com/69yXnlYRJd

Presently, Dogecoin is replicating this setup, emerging from a similar descending triangle and now consolidating. This observation has led Martinez to speculate that Dogecoin could be gearing up for another significant bull run despite a nearly 90% correction from its all-time high of $0.74.

Recent weeks have shown a slight decrease in the DOGE’s price, with variations between $0.085 and $0.0856. Despite this, the ecosystem remains vibrant, especially noted by a surge in large transactions exceeding $100,000. These transactions have contributed to a significant volume of 12.63 billion DOGE, signaling robust activity within its network.

Data from Santiment reveals an interesting trend: both smallholders and whale accounts have been increasing their DOGE holdings, indicating a shared optimism for the token’s future performance.

However, the landscape is not without its challenges. Open Interest data from Coinglass points to a decline, suggesting a decrease in market liquidity and potentially signaling a cautious stance among investors. This downturn in Open Interest and Dogecoin’s price decrease hints at a market that currently favors sellers, potentially leading to further price dips.

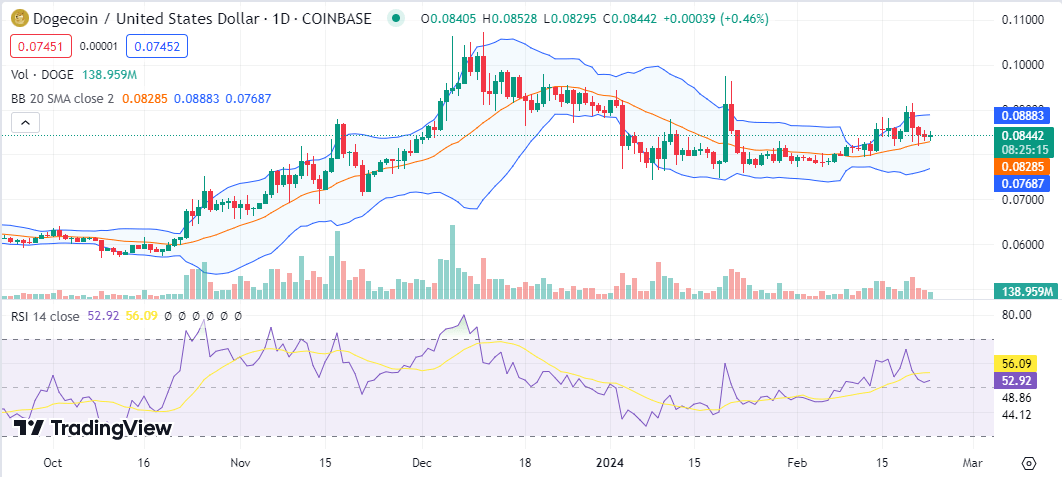

On the daily chart, the 20-day and 100-day Simple Moving Averages (SMAs) for Dogecoin are trending upwards, signaling a bullish momentum for the cryptocurrency. The Relative Strength Index (RSI) remains in a neutral zone but displays signs of tightening, suggesting an imminent price movement, whether an upward surge or a downward correction.

DOGE/USD Chart: TradingView

Additionally, Bollinger Bands indicate that Dogecoin’s price is consolidating within a narrow margin, pointing towards the potential for a notable shift soon. The bands are positioned with the upper limit at $0.0887 and the lower limit at $0.0768, highlighting the current trading range.