Today, approximately $1.54 billion worth of Bitcoin (BTCUSD) and Ethereum (ETHUSD) options are set to expire, stirring significant anticipation in the crypto market. The expiration of these options often leads to notable price volatility, prompting traders and investors to closely monitor the day’s developments.

Table of Contents

ToggleAnalyzing Bitcoin and Ethereum Options

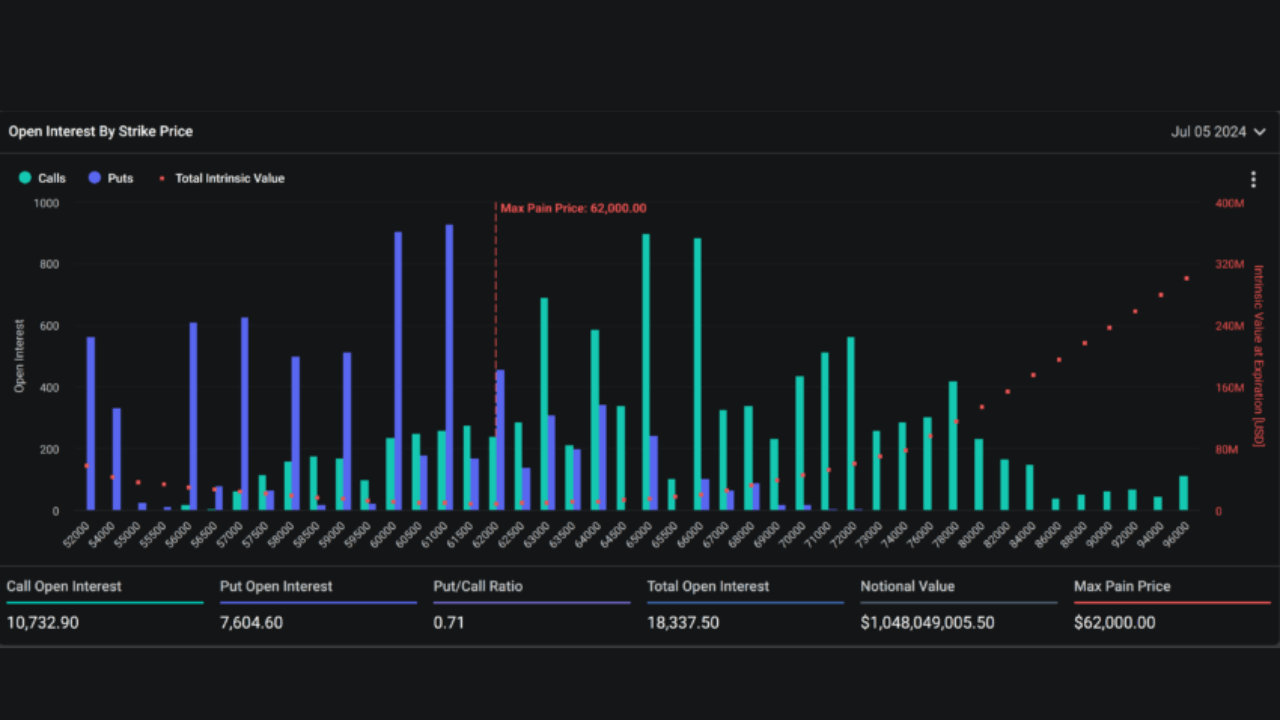

Bitcoin options expiring today have a notional value of $1.04 billion, with 18,339 contracts set to expire. These contracts exhibit a put-to-call ratio of 0.71 and a maximum pain point of $62,000. The maximum pain point in options trading represents the price level that causes the most financial discomfort for option holders. The put-to-call ratio indicates a greater prevalence of purchase options (calls) over sales options (puts), suggesting a bullish sentiment among traders.

In contrast, Ethereum has 162,782 expiring contracts with a notional value of $501.12 million. These contracts have a put-to-call ratio of 0.37 and a maximum pain point of $3,350. According to analysts at Greeks.Live, recent market sell-offs have led to significant losses for crypto markets, with BTC falling to $57,000 and ETH to $3,100.

Market Volatility and Sentiment

Data shows that BTC’s short-term implied volatility (IV) has increased by 10%. Meanwhile, the Deribit Implied Volatility Index (DVOL) has risen by 3%, and ETH-related parameters have seen a slight uptick, though not as pronounced as BTC. Skew values indicate a bearish market sentiment, reflecting traders’ cautious outlook.

“BTC Block put volume is clearly on the rise. The distribution of transactions is more complex, with the July 12 $58,000 Put being the largest one. Looking at Options Data, whales are not overly concerned about potential downside risk at the moment and are mainly adjusting their positions for last week’s quarterly delivery, particularly for ETH, where whales are showing low volatility expectations,” said analysts at Greeks.Live.

Both Bitcoin and Ethereum prices have dropped significantly this week. On July 4, BTC fell from the $60,000 level to as low as $56,964 today. At the time of writing, Bitcoin is trading at $57,037. Similarly, Ethereum dropped from $3,304 to $3,060 over the same period. ETH is now valued at $3,083, down by 3.4% in the last 24 hours.

Impact of Whale Activity and Market Movements

Industry experts attribute the recent decrease in BTC and ETH prices to heightened sell-offs from long-term whales, including governments. BeInCrypto reported that on-chain data shows the German government’s crypto wallet moved 3,000 BTC, worth approximately $174.3 million, to several destinations yesterday. These include major crypto exchanges such as Bitstamp, Kraken, and Coinbase.

While options expirations can cause temporary market disruptions, they typically lead to stabilization. Analysts’ recent insights highlight historical patterns that traders may consider when strategizing their positions. The anticipation surrounding today’s options expiration underscores the importance of vigilance in navigating market volatility.

Historical Patterns and Future Outlook

Expiring options often bring significant price swings, but they also pave the way for market stabilization. Analysts predict that post-expiration, the crypto market is likely to stabilize, reflecting historical patterns observed in previous cycles. This anticipated stabilization could provide traders with valuable insights for future strategy formulation.

Ultimately, the current volatility in the crypto market underscores the need for traders to remain vigilant. By analyzing technical indicators and market sentiment, traders can navigate the anticipated volatility more effectively. The expiring options, while creating short-term disruptions, serve as a critical juncture for assessing market trends and adjusting strategies accordingly.

As the crypto market continues to evolve, understanding the implications of options expirations and market sentiment will be crucial for traders and investors alike. The insights gained from today’s developments could offer valuable lessons for navigating future market dynamics and making informed decisions in the ever-changing landscape of cryptocurrency trading.