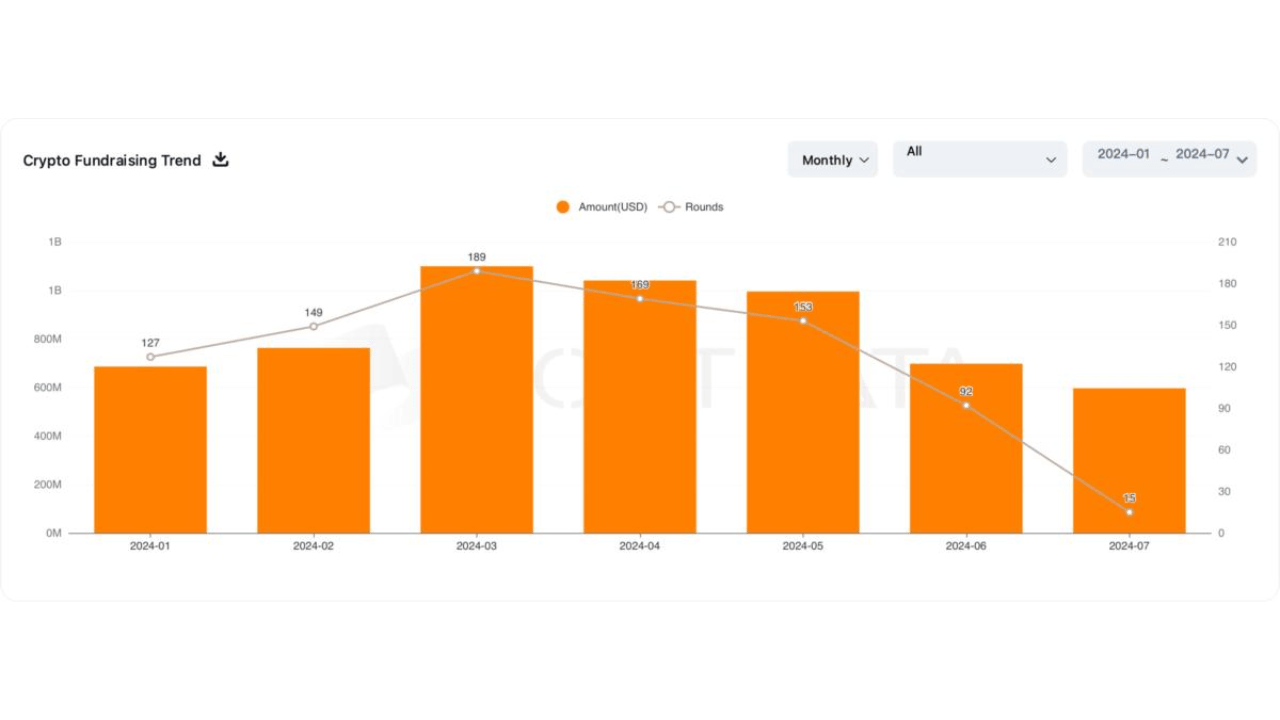

The landscape of crypto venture capital (VC) investment saw a significant shift in June. According to RootData, there were 92 publicly disclosed crypto VC investments, marking a 40% drop from May’s 153. The total fundraising amount for June was $697 million, reflecting a 30% decrease from May’s $990 million.

Table of Contents

ToggleCrypto VC Investments Decline in June

Venture capital activity serves as a barometer for major investors’ confidence and interest in the crypto market. Recent data suggests a cooling period following a particularly dynamic May. However, the market maintains a positive growth trajectory year-over-year.

The 92 disclosed crypto VC investment projects in June signify a 40% decline from May’s 153. Despite this drop, the figure represents a slight increase compared to the 87 projects recorded in June 2023. The total fundraising amount for June was $697 million, which, although 30% lower than May’s $990 million, still shows a 42% increase from the $480 million reported in June 2023.

Crypto Fundraising Trends: A Maturing Market

The fluctuations in funding volumes indicate a maturing market where strategic investments are becoming more selective amidst broader economic factors. Along with changes in funding amounts, the distribution of assets across sectors is also shifting, reflecting new priorities and trends. Despite the growing narrative around real-world assets (RWA) and decentralized physical infrastructure networks (DePIN), these sectors secured only 6% of the total investments. DeFi led with approximately 20%, followed by NFT/GameFi at 18%.

Investments in Layer 1/Layer 2 solutions accounted for 11%, while tools and wallets captured 8%. AI received around 9%, and centralized finance (CeFi) saw the lowest at about 4%. It is important to note that these figures do not include merger and acquisition deals.

Bitstamp’s $200 Million Acquisition Takes Center Stage

The most notable venture capital investment in June was Robinhood’s acquisition of Bitstamp. This deal will strengthen Robinhood’s crypto services by integrating Bitstamp’s 50 active licenses and registrations worldwide. Robinhood will also enter the institutional space with ready-made relationships, infrastructure, and products.

“As the world’s longest-running cryptocurrency exchange, Bitstamp is known as one of the most trusted and transparent crypto platforms worldwide. Bringing Bitstamp’s platform and expertise into Robinhood’s ecosystem will give users an enhanced trading experience with a continuing commitment to compliance, security, and customer-centricity,” stated Bitstamp CEO JB Graftieaux.

The acquisition, which requires customary closing conditions, including regulatory approvals, is expected to be finalized in the first half of 2025. Barclays Capital Inc. acted as Robinhood’s exclusive financial advisor, while Galaxy Digital Partners LLC advised Bitstamp.

Following Bitstamp, GRIID secured a $155 million M&A deal, and Hut 8 obtained $150 million in strategic funding, both in the mining sector. CleanSpark announced it would acquire GRIID through an all-stock transaction valued at $155 million, including payments and assumed debt. The company also entered an exclusive hosting agreement, allocating 20 megawatts of power.

Hut 8, for its part, received a $150 million investment from Coatue to develop an AI infrastructure platform. This funding will be provided through convertible notes with an 8% annual interest rate and an initial term of five years, with options to extend for up to three more years. Hut 8’s pivot towards AI is not unexpected, as BeInCrypto previously reported that following the latest Bitcoin halving, many miners are seeking new revenue streams.

Other major investments included the modular blockchain project Avail and the rollup deployment platform Conduit, which raised $43 million and $37 million, respectively. Smaller rounds were seen across various sectors, such as DeFi, AI, NFT, and GameFi, with companies like M^0, Ora, and Sandbox securing $20 million each.

Conclusion

Despite the month-on-month decline in crypto VC investments and fundraising, the year-over-year growth signifies a resilient and evolving market. The selective nature of recent investments indicates a maturing market, driven by strategic decisions influenced by broader economic factors. With major deals like Robinhood’s acquisition of Bitstamp, the crypto market continues to evolve, setting the stage for future growth and innovation.