Solana vs Avalanche – Is AVAX Better Than SOL?

Over the last two years, Avalanche and Solana, the two emerging blockchain networks, have skyrocketed in popularity, with millions of investors flocking to them. However, due to the wide similarities in their structure, a serious SOL vs. AVAX battle has ensued among market participants to decide which platform is better than the other. Known as the popular Ethereum rivals, both these networks strive to provide scalability solutions amid a low-cost and eco-friendly ecosystem. Moreover, both the platforms accommodate decentralized applications, NFTs, and smart-contracts-driven projects, thus vigorously expanding their DeFi base.

Table of Contents

ToggleSolana vs Avalanche

Avalanche overview:

Introduced in 2020, Avalanche is an open-source, smart-contracts-based blockchain that is powered by its native token, AVAX. The platform offers scalability and interoperability solutions as it works through a multiple-chain system (X-C-P), utilizing unique Avalanche consensus mechanisms (based on Proof-of-Stake).

Solana overview:

Publicly launched in 2020, Solana is a permissionless blockchain network that integrates smart-contracts functionalities like dApps, and NFTs. With its hybrid-consensus protocol (based on Proof-of-Stake), the platform maintains scalability and fast processing times with near-zero fees.

Now, let us look at Solana vs. Avalanche relative to the following metrics:

Consensus protocols

Solana blockchain establishes consensus via the Tower BFT mechanism, a variation of Proof-of-Stake, which is a combination of Practical Byzantine Fault Tolerance (pBFT) and Proof-of-History protocols. In this case, the PoH algorithm inputs additional speed and scalability to the standard pBFT functionalities of Solana. It becomes possible because PoH forwards transactions to the validators in real-time by time-stamping them instead of waiting for the entire block to be completed.

On the other side, Avalanche maintains a unique DAG-optimized Avalanche consensus protocol where transactions are processed in parallel rather than depending on one validator for confirmation. The Exchange Chain of Avalanche utilizes this protocol to mint and exchange AVAX tokens. However, the Contract and Platform Chains of Avalanche rely on a modified version of Avalanche protocol, termed Snowman. The Snowman consensus is most suitable for smart contracts as it employs the “Gossip” process and streams the transactions linearly. This innovative dual system is the prime reason for Avalanche’s increased decentralization and scaled transaction speeds.

Transactions speed

Two parameters, named TPS and TTF, are primarily used for evaluating the speed and scalability of a blockchain. TPS (transactions per second) stipulates how many transactions a network can process in one second, whereas TTF (time-to-finality) explains how long it could take to receive a coin on the blockchain.

Solana claims to process more than 65,000 TPS with finality times ranging from 0.5 to 2.5 seconds. On the other hand, it is reported that Avalanche supports approximately 4,500 TPS with a time-to-finality of around one second. But note that, in actuality, these blockchain times can be slightly higher than the estimated ones.

Staking

Although both Solana and Avalanche confide in staking, their minimum token thresholds and hardware or software requirements substantially differ if you want to become a validator. To set up an Avalanche validator node, you must stake at least 2000 AVAX (equal to $64,000 according to the current rate), which is quite hefty amount. However, Avalanche also allows the participants to delegate the stake, for which the minimum limit is capped at 25 AVAX.

In contrast, there is no specific minimum requirement to run a validator node on Solana. The network also allows the participants to delegate the coins with no minimum threshold. However, according to Solana Labs, validators should utilize a 12-core CPU and 128 GB of RAM for running their operations, which entails an expenditure of thousands of dollars.

Altogether, note that while Solana has reasonable staking costs, its software and hardware requirements translate to several thousands of dollars. On the other hand, Avalanche is relatively lenient on the equipment requirements, but the minimum staking costs are higher.

Latest developments

Both Solana and Avalanche actively keep introducing new developments, expanding their respective spaces. To note some latest Solana happenings, Rarible and OpenSea, the two most popular NFT marketplaces, have recently started integrating NFTs minted on the Solana blockchain. The network’s team is also set to launch NEON, a fully Ethereum compatible environment on Solana, anytime during Q2 of 2022. Further, last month Phantom, the fastest-growing crypto wallet designed for Solana, launched an iOS and Android version of the wallet to accommodate the needs of more than 3 million active users.

On the other hand, Avalanche is also brimming with numerous positive developments, with its Avalanche Metaverse at the top spot. According to the developers, this metaverse is an incentive program built to support new ecosystems and accelerate the adoption of sub-nets. Aside from this, there are hundreds of AVAX use cases; for instance, Wildlife studios have recently announced to bring their popular game (Castle Crush) to Web3 on Avalanche. Moreover, not long ago, Terraform Labs (TF) purchased more than 1 million AVAX to be used for the Terra reserve pool.

The DeFi ecosystem

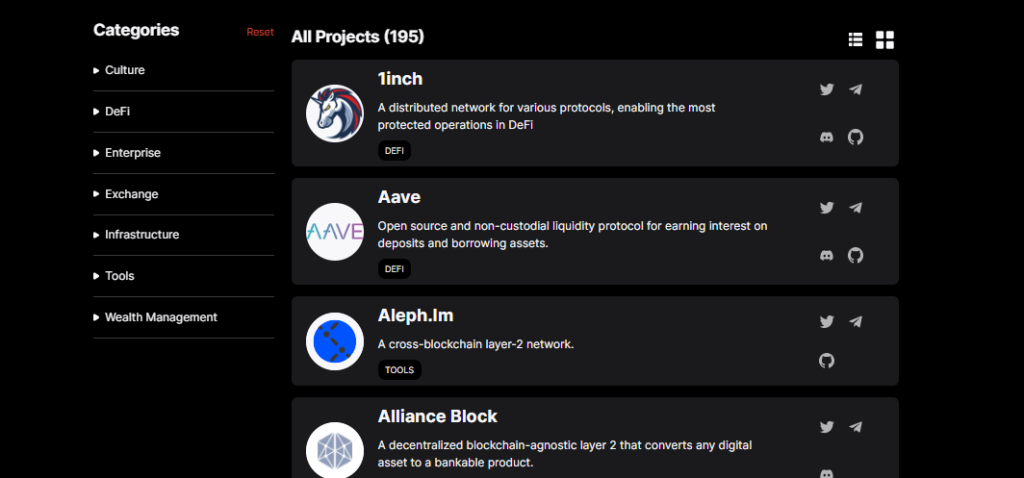

Both networks assimilate impressive ecosystems with diverse projects. As per the latest statistics, Solana has more than $4.5 billion locked on its DeFi ecosystem, comparable to Avalanche, which has almost similar TVL. However, note that the Solana blockchain hosts significantly more dApps (1586 projects) than Avalanche (195 projects).

Solana consolidates a broad spectrum of projects belonging to multiple categories, such as DeFi, Lending, NFT marketplaces, Web3 apps, and DEX. Some prominent projects anchored by Solana include Phantom (Solana wallet for staking, NFTs, and DeFi), Audius (Decentralized music sharing platform), Orca (user-friendly cryptocurrency exchange), and Metaplex (NFT marketplace), among others.

Avalanche also hosts a broad range of projects related to different categories, such as DeFi, Enterprise, Exchange, Tools, etc. The blockchain supports several leading projects like AVME (desktop wallet for Avalanche), Benqi (non-custodial liquidity market pool), Avalaunch (launchpad for innovative projects), and Traderjoe (an Automated Market Maker based DEX), among others.

Conclusion – Solana vs Avalanche: Which one is better?

Undoubtedly, both Solana and Avalanche incorporate immense potential with their cost-efficient structure, high scalability, and large supportive communities. Overall, Avalanche might be a better bet as it has been less criticized over network outrages and holds a Nakamoto coefficient of 27 (more decentralized) as compared to Solana’s 19. Moreover, Avalanche shines with its interoperability feature and limited maximum supply where AVAX tokens are regularly incinerated, pushing the demand higher.

In contrast, Solana has faced some notable denunciation due to its frequent network congestions and partial-centralization allegations. However, it does not necessarily mean that this blockchain falls behind Avalanche. It is because Solana’s mainnet is still in its Beta phase, and the current faults are easily fixable. Moreover, Solana withholds remarkable qualities such as lightning-fast speeds and the lowest fees. The network also sustains a vast DeFi ecosystem supported by renowned institutions and platforms.

All in all, it is not a bad idea to diversify your portfolio with both AVAX and SOL to capitalize on the rolling DeFi trend.