Key Points

- The U.S. Congress has decided to revoke Russia’s trading status, prohibit all new investment in the country, and sanction President Vladimir Putin’s daughters.

- Investors are assessing the Fed’s intentions to tighten its balance sheet and raise interest rates in order to limit spiralling inflation.

LONDON, U.K. — Investors examine the pace of the Federal Reserve’s monetary tightening plans and news from Ukraine as European markets advanced on Friday to cap a turbulent trading week.

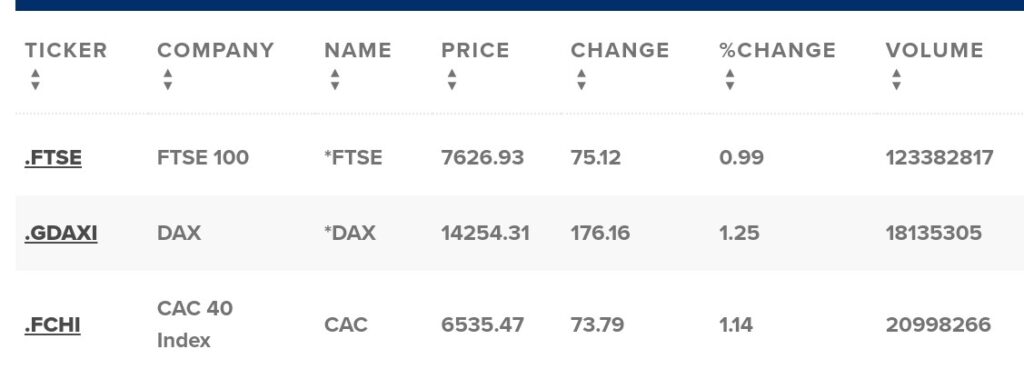

In early trading, the Stoxx 600 index rose 1.1 per cent, with cars leading the way with a 1.7 per cent gain, as all sectors and major bourses entered positive territory.

The European blue-chip index ended the day slightly lower, after having risen by approximately 0.8 per cent at one point, as volatility remained high following disclosures of the Federal Reserve’s plans to tighten its balance sheet and raise interest rates to curb inflation.

After claims of rape and torture against civilians by Russian forces in Ukraine, the U.S. Congress decided to remove Russia’s trading status, ban oil and gas imports, prohibit all new investment in the country and sanction President Vladimir Putin’s daughters.

G-7 members condemned the crimes and resolved to expel Russia from the United Nations Human Rights Council. Dmytro Kuleba, Ukraine’s foreign minister, met with G-7 and NATO leaders in Brussels to discuss arms deliveries to Ukraine.

New penalties against Russia have also been adopted by the European Union, including a landmark embargo on Russian coal imports.

As China confronts another increase in cases, investors worldwide are keeping an eye on the consequences of its strict Covid-19 limits, which might further disrupt global supply chains.

Markets in Asia-Pacific gave up early gains on Friday, losing overnight momentum from a Wall Street bounce as investors kept an eye on the Federal Reserve’s efforts to combat inflation.

After the significant averages mounted a late-day rebound on Thursday, it barely changed U.s. stock futures in early premarket action.