Key Insights:

- Ethereum’s ascent over $3.2k marks a 43% rise since February, spotlighting the impact of spot ETF anticipation on its valuation.

- The Ethereum network prepares for the Dencun and proto-dank sharding upgrades, aiming to enhance scalability and reduce transaction fees.

- Ethereum’s price increase to $3,264, amid a broader crypto rally led by Bitcoin’s surge, positions ETH for potential growth towards the $3,600 mark.

Ethereum has charted a remarkable trajectory, breaking the $3,000 barrier with solid bullish momentum and currently above $3,200. Over the last month, it has seen an impressive 43% increase from its previous position at $2,200. This comes amidst a broader market rally led by Bitcoin, which reached a two-year high of $58,000, gaining 10 % in the past week.

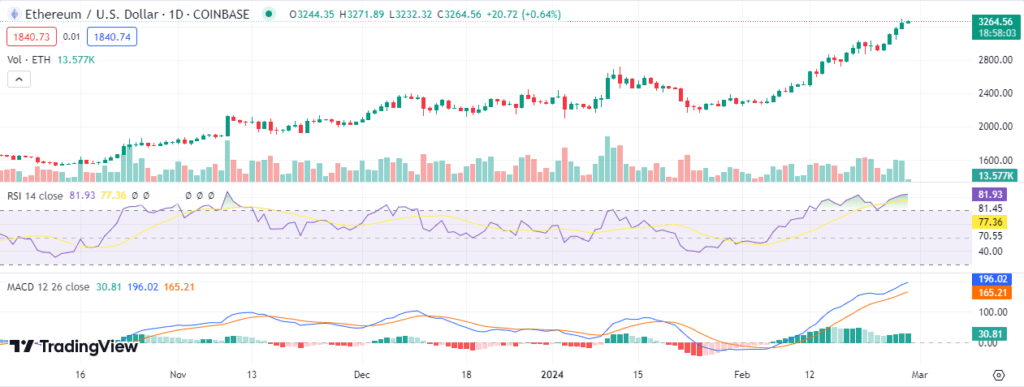

As of this writing, ETH is exchanging hands at $3,264, up by over 1% in the past 24 hours. ETH’s daily low is seen at the $3,200 level, while the daily high remains at $3,290, acting as the immediate resistance for ETH. Should the bullish trend remain in play, ETH could rally toward the $3,600 level in the coming sessions.

Why is Ethereum on the rise?

Data analytics firm CryptoQuant highlights the transformative potential of spot crypto ETFs for market capitalization, suggesting a long-term increase exceeding $1 trillion. This projection ties closely to the heightened anticipation surrounding the approval of Ethereum-based ETFs.

Financial giants such as Franklin Templeton, BlackRock, and Fidelity have thrown their hats into the ring, proposing spot Ether ETFs. These financial instruments aim to provide investors with direct exposure to ETH, minus the complexities of managing a digital wallet.

The crypto community is keenly awaiting May 23, 2024, a critical date by which the SEC will decide on the fate of these Ether ETF applications. This decision could significantly influence Ethereum’s market trajectory.

Moreover, Ethereum’s diminishing supply further fuels price optimism. According to Ultrasound Money, the network is witnessing a supply reduction of about 0.5% annually, with a recent drop of 11,500 ETH from its circulating supply.

In preparation for upcoming network enhancements, the Ethereum Foundation has issued a call to action for node operators. They are to update their systems to support the Dencun upgrade, a pivotal development combining changes across both the consensus and execution layers of the Ethereum blockchain.

Additionally, the network is on the cusp of implementing its proto-danksharding upgrade. Successfully tested on three testnets; this upgrade is scheduled for a mainnet launch around March 13. Proto-danksharding represents a critical step toward Ethereum’s sharding vision, promising significant fee reductions for Layer 2 chains through the introduction of blobs.

Ethereum Technical Outlook

Throughout February, the Chaikin Money Flow (CMF) indicator consistently stayed above the neutral zero level, reaching a peak of +0.38. This indicated a strong bullish sentiment towards Ethereum among both investors and traders. ETH’s bullish outlook is further confirmed by the Relative Strength Index (RSI), which has recorded a high reading of 81.93, indicating a robust bullish momentum in the market.

The MACD indicator suggests a strong bullish momentum in ETH’s market as the MACD line continues its upward journey above the signal line. The histogram coincides with the uptrend, too, as it continues to paint a green picture, suggesting a rise in buying pressure.