Key Insights:

- Dogecoin’s recent ascent to $0.2062 highlights a 6% daily increase, fueled by the rise in trading volume, marking significant market optimism.

- Dogecoin’s steadfast hold above the $0.20 support zone hints at a potential surge to the $0.30 mark, buoyed by investor confidence.

- Dogecoin witnesses a hike in trading volume to $3.4 billion, alongside a 6% rise in open interest, signaling robust market engagement.

Dogecoin, the cryptocurrency born from an internet meme, has made headlines with its notable surge in value. It is now aiming for the elusive $1 mark. Recently, the price of digital currency ascended beyond $0.20, demonstrating strong bullish momentum. Over the past month, DOGE has witnessed a remarkable 20% increase in value, securing its place as one of the top-performing meme coins. Moreover, a year-over-year growth of 130% underscores its potential to reach new heights.

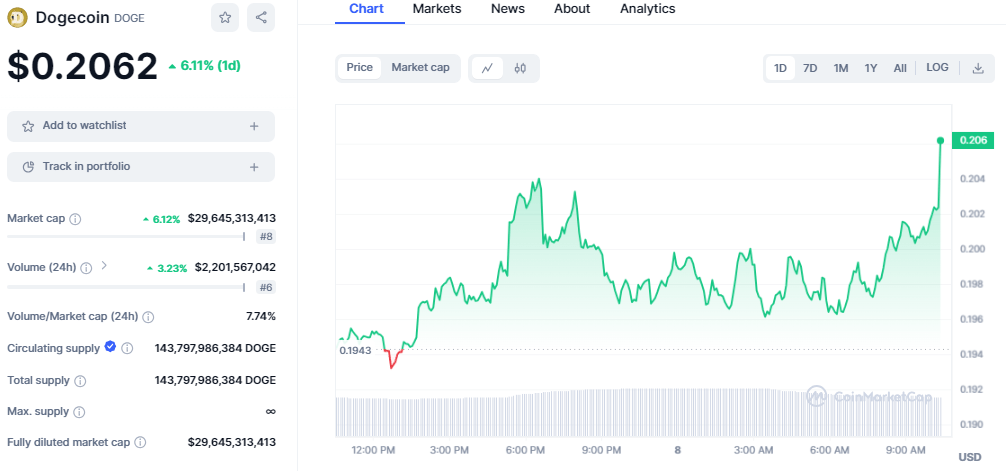

Following a period of consolidation earlier in the week, DOGE has shown impressive resilience, currently trading at $0.2062. This represents a 6% gain within a single day. Additionally, the trading volume for Dogecoin has experienced a significant boost, now standing at approximately $2.2 billion. This surge indicates a growing interest from both traders and investors.

DOGE/USD price chart: CoinMarket Cap

Currently, DOGE occupies the 8th position on CoinMarketCap’s rankings, boasting a market capitalization of $29 billion. This remarkable valuation reflects the cryptocurrency’s increasing acceptance and the enthusiasm surrounding it. Consequently, Dogecoin continues to gain momentum in the cryptocurrency market, evidencing the potential for further growth.

Dogecoin Price/Technical Analysis

DOGE has recently solidified its standing above the key $0.20 level, underscoring a significant phase of stability and support. This achievement sets the stage for a potential advance towards the $0.30 milestone. In the year 2024 alone, DOGE has seen its value double, showcasing a robust rally that captivates market observers and investors alike.

Furthermore, on the daily trading chart, DOGE has faced resistance at the $0.22 mark. Surpassing this barrier could propel the cryptocurrency towards sustained upward movement, aiming for the psychologically important $0.30 level. Achieving such a price point would not only underscore Dogecoin’s market resilience but likely elevate its market capitalization beyond the $30 billion threshold.

The technical analysis reveals a key point for Dogecoin at $0.18, a threshold that plays a critical role in its market trajectory. Moreover, the asset faces immediate resistance levels at $0.20, $0.22, and $0.25. Surpassing these milestones is essential for Dogecoin to continue its upward movement.

On the flip side, support levels at $0.17, $0.14, and $0.12 stand as vital safeguards against potential declines. Significantly, the Relative Strength Index (RSI), a trusted measure of market momentum, sits at 62. This indicator suggests that the recent market activity has been largely dominated by buyers, reinforcing the asset’s bullish stance.

DOGE/USD 4-hour chart

Additionally, the 50-day Exponential Moving Average (EMA), currently at $0.18, provides technical support that corroborates the optimistic outlook for DOGE. A noteworthy breakout from a previous downward channel, particularly at the $0.1885 resistance level, coupled with positive indicators from both RSI and EMA, lays the groundwork for potential continued growth.

Factors Fueling Dogecoin’s Rise

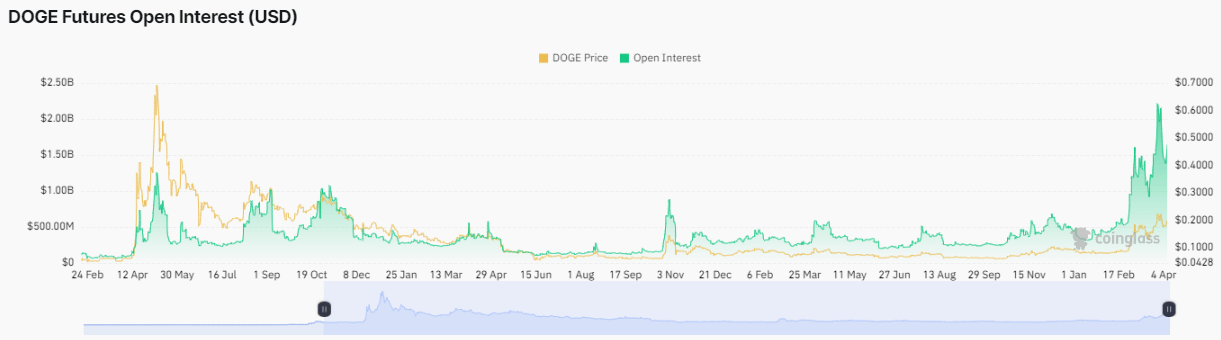

Dogecoin has recently seen a remarkable uptick in its market performance, buoyed by several bullish indicators. CoinGlass data reveals that the trading volume for Dogecoin has escalated by 19%, amassing a significant $4.16 billion. This surge reflects a growing fascination and involvement in the Dogecoin market, potentially setting the stage for further increases in its value.

DOGE Open Interest Chart: Coinglass

Moreover, the cryptocurrency has seen a remarkable 6% increase in open interest, amounting to $1.67 billion. Notably, Binance holds a substantial slice of this pie with $543 million, followed closely by Bybit at $436 million and BingX contributing $213 million. This diversified engagement across trading platforms highlights the broad-based support for Dogecoin among traders.