Key Insights:

- Bitcoin’s Realized Cap Age Bands echo patterns from past bullish cycles, indicating a promising start to the current uptrend.

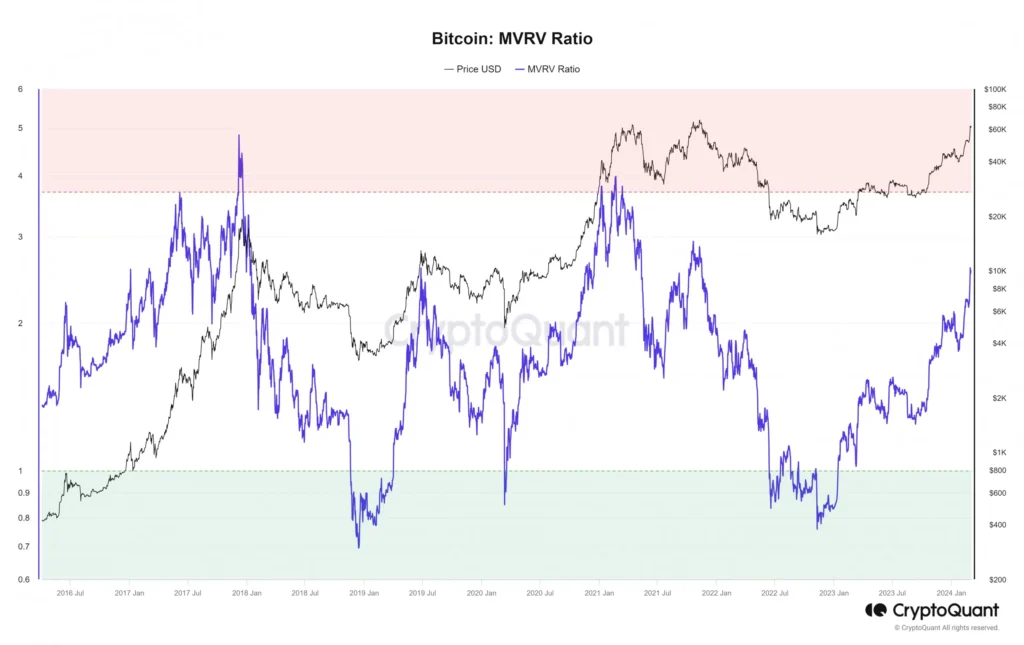

- Active addresses nearing 2021 highs and an MVRV ratio of 2.59 suggest that Bitcoin’s rally may just be in its early phases.

- Ali Martinez observed that strategic buying boosts collective confidence, fortifying Bitcoin’s stance against potential market fluctuations.

Bitcoin enthusiasts have reason to cheer as key metrics indicate a robust start to the bull run, with the cryptocurrency gaining 20% on the weekly chart. While some holders are starting to sell, this isn’t a red flag but rather a positive signal for the market.

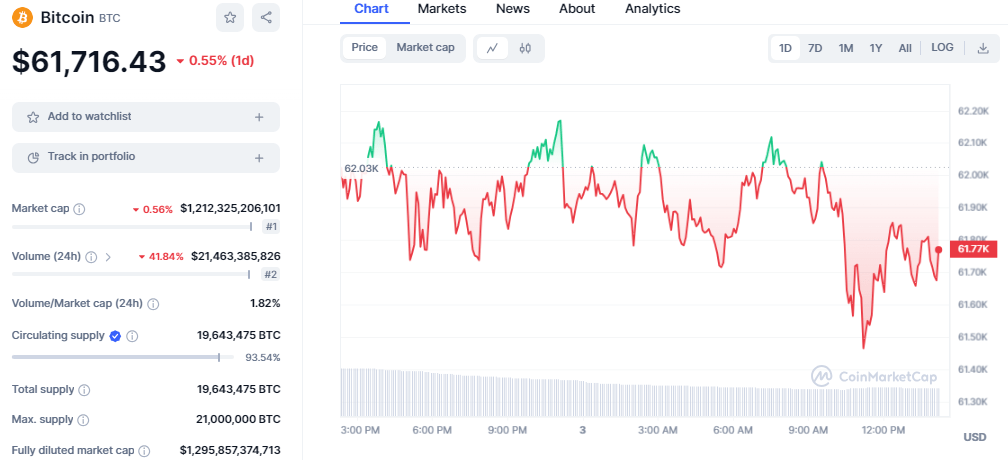

As of this writing, BTC is exchanging hands at $61,716 as bulls resist the downtrend. In today’s session, BTC has been trading in the positive region despite the bears taking charge in the past few hours as the price dropped to a daily low at $61,435, which is acting as the current support level. The trading volume has dropped by 40% as it stands at $21.4 billion, suggesting an increase in selling pressure.

BTC/USD price chart: CoinMarket Cap

Bitcoin surged from the $51k level, breaking the key resistance levels to climb above the $60k mark to touch the $64k mark on 28th February. Since facing a new resistance at this level, BTC dropped toward the $61k level, where it has been consolidating since the start of March. Currently, the bears and bulls are in a battle for control, which could signal BTC could head in either direction as the market is in equilibrium.

Ali Martinez, a renowned crypto analyst on X, sheds light on Bitcoin’s robust position as it maintains stability above a substantial support barrier. Over 1 million addresses have collectively acquired more than 671,000 BTC within the price bracket of $60,334 to $62,155.

#Bitcoin holds above a massive support wall, with 1 million addresses buying over 671,000 $BTC within the price range of $60,334 to $62,155.

— Ali (@ali_charts) March 1, 2024

This accumulation zone highlights strong investor confidence and could serve as a crucial level of support for #BTC, potentially… pic.twitter.com/lmghohWR1U

This accumulation zone signifies a formidable display of investor confidence, presenting a pivotal support level for BTC. This strategic buying spree not only showcases market resilience but also acts as a potential safeguard, mitigating the impact of any impending downturns.

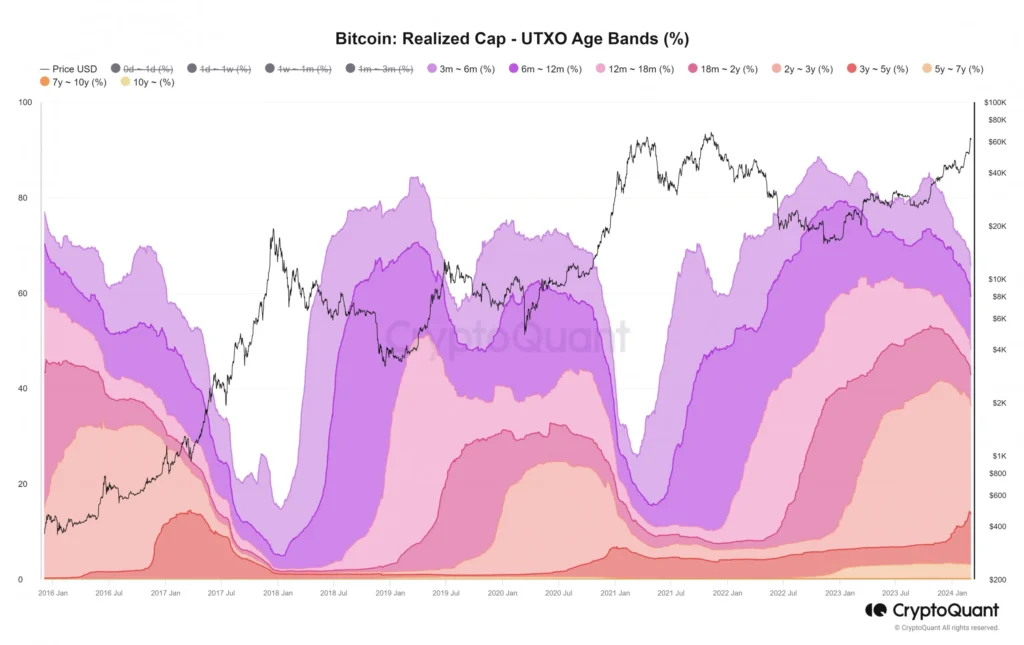

Realized Cap Age Bands Signal Bull Run Kickoff

Analyzing the Realized Cap-UTXO Age Bands shows that the capitalization held by short-term and long-term holders is shifting. Similar trends were observed in the latter half of 2017 and 2021, marking the initiation of bullish cycles. The recent decline in age bands for 3 to 6-month and 6 to 12-month holders aligns with historical bull runs.

While active addresses have surged close to the 2021 high, the 30-day simple moving average shows a downward trend despite rising prices. Historically, active addresses and prices moved constantly, increasing user interest with price surges.

The MVRV ratio hitting 2.59, a level unseen since November 2021, suggests room for further ascent. Contrary to concerns, any pullbacks or corrections should be seen as opportunities, considering the MVRV was not higher than 2.6 even when prices hit $12k in 2019.

The data implies that Bitcoin’s bull run is in its early stages. With the MVRV ratio offering ample space for growth and active addresses poised for potential expansion, investors have reason to be optimistic.

Bitcoin Technical Outlook

Bitcoin encounters bearish indicators as its Relative Strength Index (RSI) ventures into the overbought territory, signaling a potential surge in selling pressure. Adding to the concerns, the Chaikin Money Flow (CMF) displays a downward trend, indicating a higher likelihood of BTC’s price experiencing a decline in the coming week.

BTC/USD chart: TradingView

The MACD indicator shows a decrease in the bullish momentum as the histogram shifts toward the zero line, which could lead to a bearish reversal. The MACD line has changed its upward direction as it starts declining toward the signal line. Finally, BTC has faced a stiff rejection on the upper Bollinger Band, forming a series of red candlesticks that suggest a shift in the upward momentum.